Loading

Get Nab Personal Overdraft

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Nab Personal Overdraft online

Completing the Nab Personal Overdraft application form online can be a straightforward process. This guide aims to provide you with step-by-step instructions to help you fill out each section accurately and efficiently.

Follow the steps to successfully complete your application.

- Click ‘Get Form’ button to obtain the form and open it in an accessible editor.

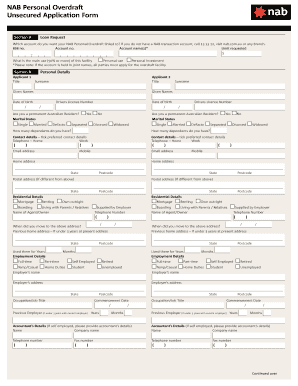

- Begin by filling out Section A, where you will indicate your loan request. Specify which account you want the NAB Personal Overdraft linked to by providing the account's BSB number, account number, and account name(s). Indicate the limit you are requesting and select the main use for the facility (Personal use or Personal investment). Please remember that if the account is joint, all parties must complete the application.

- Proceed to Section B, which collects your personal details. You will enter information for Applicant 1 and, if applicable, Applicant 2. This includes titles, surnames, given names, dates of birth, driver's license numbers, residency status, and marital statuses. Include details about dependents and preferred contact methods.

- Next, provide your residential details. Specify whether you are renting, boarding, living with relatives, or own your home outright. You will also need to provide the name and telephone number of your landlord or agent if renting.

- Complete the employment details section. Specify your employment status, employer's name, address, occupation, and commencement date. If self-employed, include your accountant’s details.

- Then, answer the reference section, confirming if there have been any financial judgments or legal proceedings against any applicant. Provide details of the nearest relative not living with you, including their address and relationship to you.

- In the financial position section, outline your monthly income, general living expenses, and other assets and liabilities. Accurately report your financial details for both applicants to provide a complete picture of your financial status.

- Read the important customer consent information regarding the privacy of your provided personal information, and sign where indicated. Ensure you acknowledge the information you have read regarding credit checks and your rights.

- Lastly, both applicants must sign and date the form to verify the accuracy and completeness of the information provided before submitting the application.

Complete your Nab Personal Overdraft application online today to manage your financial needs effectively.

You'll need to enrol in your bank's overdraft protection plan to overdraft your bank account on purpose. Overdraft protection authorizes the bank to let you spend more than you have. It also means that you agree to pay your bank's fees for this privilege. Overdraft fees vary by bank.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.