Loading

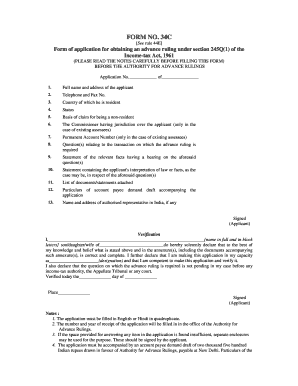

Get 34c In Income Tax Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 34c In Income Tax Form online

Filling out the 34c In Income Tax Form online is a crucial step for those seeking an advance ruling under section 245Q(1) of the Income-tax Act. This guide will provide you with clear instructions on how to navigate each section of the form effectively.

Follow the steps to complete your application process smoothly.

- Press the ‘Get Form’ button to acquire the form and open it in your chosen editor.

- Provide your full name and address in the corresponding fields. Ensure that the details are accurate and up-to-date.

- Enter your telephone and fax numbers to facilitate communication.

- Indicate the country of which you are a resident. This applies to individuals and entities alike.

- State your status (individual, company, etc.) clearly in the required section.

- If you are an existing assessee, provide the name of the Commissioner having jurisdiction over you.

- Enter your Permanent Account Number (PAN) if you are an existing assessee.

- Clearly state the question(s) relating to the transaction for which the advance ruling is needed. Ensure that these are based on actual or proposed transactions.

- In Annexure I, list the relevant facts that have a bearing on your question(s). This may include business details and the purpose of the transaction.

- In Annexure II, provide your interpretation of the law or facts regarding the question(s) outlined.

- Attach a list of any supporting documents or statements that are relevant to your application.

- Include particulars of the account payee demand draft that accompanies your application, such as its amount and payee details.

- If applicable, mention the name and address of your authorized representative in India.

- Sign the application, ensuring to fill in the declaration section accurately.

- Lastly, save your changes, download, print, or share the form as necessary to complete your submission.

Start filling out your 34c Income Tax Form online to ensure your advance ruling request is submitted promptly.

An application (in quadruplicate) for advance ruling shall be made by a resident applicant,for determination of his tax liability arisingout of one or more transactions valuing Rs. 100 crore or more in total which has been undertaken or is proposed to be undertaken by him,in Form No. 34DA.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.