Loading

Get Edf Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Edf Form online

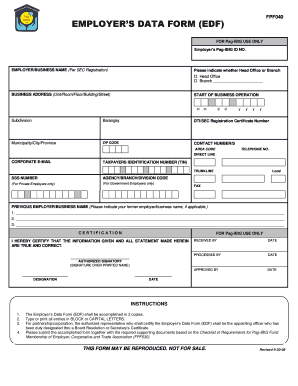

Filling out the Edf Form online is a straightforward process that requires attention to detail. This guide will walk you through each section of the form to ensure you provide accurate information and complete the submission successfully.

Follow the steps to complete the Edf Form online.

- Click ‘Get Form’ button to obtain the form and open it in the online editor.

- Fill in the employer's Pag-IBIG ID number. Ensure this number is accurate as it identifies your business within the Pag-IBIG system.

- Enter the employer or business name as registered with the Securities and Exchange Commission (SEC). Indicate whether this is a Head Office or Branch by selecting the appropriate checkbox.

- Provide the business address in the designated fields. Be sure to include unit, room, floor, building, street, and specify the municipality, city, province, and ZIP code.

- Input the contact numbers, including area code and telephone number. If applicable, provide a corporate email address and taxpayer identification number (TIN).

- Complete the additional fields for trunkline, SSS number (for private employers), and any agency/branch/division code if you are representing a government employer.

- If you have a previous employer or business names, list them in the section provided. Include all relevant details about these previous affiliations.

- At the bottom of the form, an authorized signatory must certify that the information provided is true and correct by signing in the designated area. Include their name and designation, as well as the dates of signature and processing.

- Review all entered information for accuracy before submitting. Once verified, you can finalize your form submission by saving changes, downloading, printing, or sharing the completed form as needed.

Start filling out your Edf Form online today for a streamlined submission process.

Any retirement pension not exceeding the Income Exemption Threshold (IET) in respect of Category A payable to a citizen of Mauritius who is not resident in Mauritius. An employee whose emoluments do not exceed Rs 25, 000 per month is an exempt person and is not subject to tax deduction under the PAYE System.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.