Loading

Get Cnmidof

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Cnmidof online

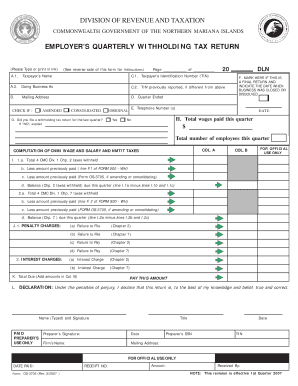

Filling out the Cnmidof form, also known as the employer's quarterly withholding tax return, can initially seem complex. This guide provides a clear and structured approach to completing the form online, ensuring that you accurately report your tax information.

Follow the steps to accurately complete the Cnmidof form online.

- Press the ‘Get Form’ button to access the form and open it in your preferred digital editor.

- In section A.1, enter the name of the owner for the business, whether it is a sole proprietorship, partnership, or corporation.

- In section A.2, indicate the name under which your business operates, such as 'John Doe’s Restaurant'.

- Section B requires you to provide your complete mailing address, including any post office box you may have.

- In section C.1, input your Taxpayer Identification Number (TIN), which you may need to acquire from the Division of Revenue and Taxation if you do not already have one.

- Use section C.2 to enter your Employer Identification Number if it differs from the previous quarter.

- For section D, specify the quarter that has ended for the return you are filing.

- In section E, include your telephone number(s) for contact purposes.

- If this is your final return, mark the box in section F and indicate the closure date of your business.

- Answer section G, checking 'Yes' if you filed a withholding tax return for the last quarter, or 'No' and provide an explanation if you did not.

- In section H, record the total wages paid this quarter along with the total number of employees.

- Proceed to section I to compute your CNMI wage and salary taxes. Fill out subsections 1 and 2 carefully, entering withheld amounts and previous payments as directed.

- Complete section J for any penalties or interest charges applicable to your case, taking into account the specific penalties and interest for Chapter 2 and Chapter 7 taxes.

- In section K, add the amounts from column B to find the total amount due this quarter, which you need to enter prominently.

- In section L, declare your return is true and correct by signing the form. Ensure that it is signed by an authorized person, as outlined.

- Once all sections are filled out, save your changes, download the completed form, print it if necessary, or share it as required.

Take action today and complete your Cnmidof form online to ensure compliance and timely submission.

Teachers can use vines, ruffled ribbon, kite paper garlands, wired ribbon, tissue flowers, tulle, and burlap ribbon. You can think of these examples as border trim alternatives, since most bulletin boards have the standard straight or scalloped trims.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.