Loading

Get Ap-224 Texas Business Questionnaire - Texas Comptroller Of Public ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AP-224 Texas Business Questionnaire - Texas Comptroller Of Public Accounts online

Completing the AP-224 Texas Business Questionnaire is an important step for entities operating in Texas. This guide provides clear instructions to help users navigate the online form efficiently and accurately.

Follow the steps to complete the AP-224 form online.

- Click ‘Get Form’ button to obtain the questionnaire and open it in the editor.

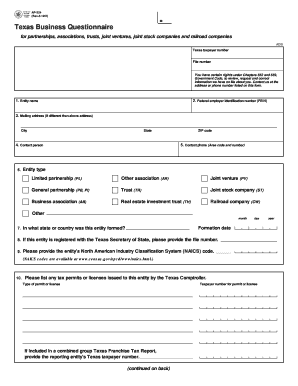

- Enter the entity name in the provided field. This is the official name registered with the state.

- Provide the Federal Employer Identification Number (FEIN) assigned to the entity.

- If the mailing address differs from the entity's physical address, input the mailing address, including city, state, and ZIP code.

- Specify a contact person for the entity and include their contact phone number, making sure to include the area code.

- Select the entity type from the list provided, including options like limited partnership, general partnership, and trust.

- Indicate the state or country where the entity was formed and provide the formation date.

- If applicable, enter the file number provided by the Texas Secretary of State for registered entities.

- Fill in the North American Industry Classification System (NAICS) code for the entity, which can be found through a relevant online resource.

- List any tax permits or licenses that have been issued by the Texas Comptroller, along with their taxpayer numbers.

- Complete the information for all members, general partners, and any limited partners with a 10% or greater ownership interest. Provide their names, mailing addresses, ownership types, and Federal Employer Identification Numbers.

- Confirm that the provided information is accurate, sign, and date the form as the preparer.

- Once all sections are completed, users can save changes, download, print, or share the form as needed.

Complete your documents online today for a seamless filing experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Each taxable entity formed in Texas or doing business in Texas must file and pay franchise tax.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.