Loading

Get 2012 I-012 Wisconsin Form Eic-a - Dor State Wi

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2012 I-012 Wisconsin Form EIC-A - Dor State Wi online

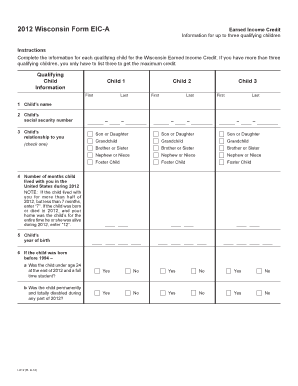

Filling out the 2012 I-012 Wisconsin Form EIC-A online is an essential step for individuals claiming the Earned Income Credit for qualifying children. This guide provides clear, step-by-step instructions to help you complete the form accurately and efficiently.

Follow the steps to successfully complete your form.

- Click 'Get Form' button to obtain the form and open it in the editor.

- Begin by providing the information for Child 1 in the designated fields. Enter the child's full name in the First and Last name sections.

- Indicate the relationship of Child 1 to you by checking the appropriate box: Son or Daughter, Grandchild, Brother or Sister, Nephew or Niece, or Foster Child.

- Fill in the number of months Child 1 lived with you in the United States during 2012. If the child lived with you for more than half of the year but less than seven months, enter '7'. If the child was born or died in 2012 and lived with you for the entire time, enter '12'.

- Enter the child’s year of birth in the specified field.

- Repeat steps 2-5 for Child 2 and Child 3, ensuring that all fields are filled out correctly.

- Once all information is entered for up to three qualifying children, review the entire form for accuracy.

- After ensuring everything is correct, you can save your changes, download the form, print it, or share it based on your needs.

Complete your documents online today to ensure your Earned Income Credit is accurately claimed.

Yes. Section Tax 2.08, Wis. Adm. Code, requires fiduciary returns (Form 2) and partnership returns (Form 3) to be filed electronically if the department has provided notification of the requirement to electronically file at least 90 days prior to the due date of the first tax return to be filed electronically.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.