Loading

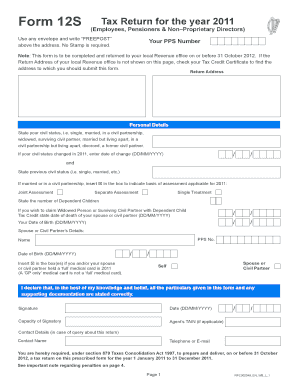

Get Form 12s - Tax Return For The Year 2011. Tax Return For 2011 For Employees, Pensioners &amp

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 12S - Tax Return For The Year 2011 for employees, pensioners & online

Filing your tax return is an important process, and completing the Form 12S for the year 2011 can seem daunting. This guide is designed to provide you with clear and concise steps to help you fill out the form accurately and efficiently.

Follow the steps to complete your Form 12S successfully.

- Click ‘Get Form’ button to obtain the form and open it in your preferred editor.

- Begin by entering your personal details, including your PPS number and civil status. Ensure you clarify if you are single, married, in a civil partnership, etc.

- State the date of birth in the specified format (DD/MM/YYYY). If your civil status changed during 2011, provide the date of change and previous civil status.

- For those who are married or in a civil partnership, indicate the basis of assessment for 2011 by placing 'T' in the appropriate box.

- List the number of dependent children and provide details of your spouse’s or civil partner’s PPS number, name, and date of birth.

- Declare if you or your spouse/civil partner held a full medical card in 2011 by marking the appropriate box.

- In the income section, document employment or pension details. Include employer name, gross pay for USC, amounts deducted for USC, and tax deducted, using figures rounded to the nearest Euro.

- If applicable, complete additional sections for further sources of PAYE income, detailing various payments from the Department of Social Protection and any other income not subject to PAYE.

- Claim tax credits, allowances, and reliefs where applicable by marking the boxes provided, and include descriptions and amounts in the Additional Information section as necessary.

- Fill in your bank details for tax refunds, ensuring to provide the sort code and account number accurately.

- Finalize your form by signing and dating it, indicating your capacity as the signatory. Submit any additional documents as necessary.

- Review all information for accuracy before saving changes, downloading, printing, or sharing the completed form.

Complete your Form 12S online to ensure a smooth tax return process.

There are over 800 various forms and schedules. Other tax forms in the United States are filed with state and local governments.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.