Loading

Get Substitute Form W-9 - Nyc Office Of The Comptroller - Comptroller Nyc

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Substitute Form W-9 - NYC Office Of The Comptroller - Comptroller Nyc online

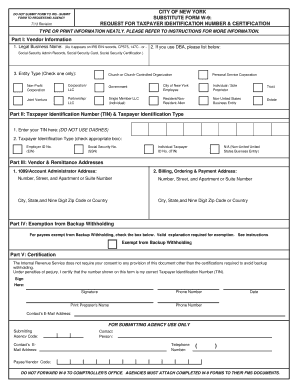

The Substitute Form W-9 is an important document required by the NYC Office of the Comptroller to request taxpayer identification information. This guide will provide you with clear, step-by-step instructions to fill out the form accurately online.

Follow the steps to complete the Substitute Form W-9 online.

- Click 'Get Form' button to obtain the form and open it in the appropriate editor.

- In Part I, provide your legal business name exactly as it appears on IRS records. If applicable, include your DBA (doing business as) name.

- Select your entity type by checking the appropriate box. Ensure you only check one option from the list of entity types provided, such as Corporation, Non-Profit Organization, Individual/Sole Proprietor, or others.

- In Part II, enter your Taxpayer Identification Number (TIN) without dashes. Then, mark the box that corresponds to your taxpayer identification type, which could be an Employer ID Number, Social Security Number, Individual Taxpayer ID Number, or indicate if you are a non-United States business entity.

- Part III requires you to provide your vendor and remittance addresses. Include the 1099/Account Administrator address, followed by your billing, ordering, and payment address. Make sure to include the city, state, and nine-digit zip code.

- In Part IV, check the box if you are exempt from backup withholding. A valid explanation for exemption may be necessary, so refer to the form instructions for guidance.

- Part V is the certification section where you will need to sign and date the form. Provide your phone number, contact's email address, and print the preparer's name if different from yours.

- Upon completing the form, review all information to ensure accuracy. You can then save your changes, download a copy of the form, print it for your records, or share it as needed.

Complete your Substitute Form W-9 online to ensure prompt processing of your taxpayer information.

A W-8 form allows non-US individuals and businesses to confirm they are not US taxpayers. A W-8 form from the US Internal Revenue Service (IRS) allows non-US individuals and businesses to confirm they are not a US taxpayer. There are different variations to the W-8 form, each of which serves a different purpose.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.