Loading

Get Taxation Of Dual Status Aliensinternal Revenue Service - Irs.gov

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Taxation Of Dual Status AliensInternal Revenue Service - IRS.gov online

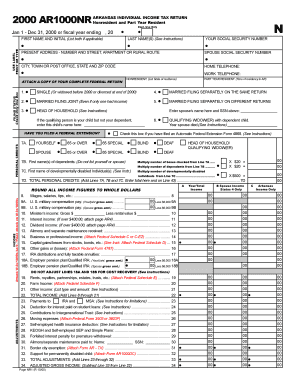

Filling out the Taxation of Dual Status Aliens form from the IRS can seem overwhelming, but with guidance, you can navigate it with ease. This comprehensive guide will provide you with step-by-step instructions to ensure accurate completion of the form online.

Follow the steps to complete your taxation form accurately.

- Click ‘Get Form’ button to access the form and open it in the editor.

- Begin by entering your first name and initial, followed by your last name as specified. Ensure that your present address is clearly indicated, including the number and street, apartment or rural route.

- Input your Social Security number and the Social Security number of your spouse if applicable.

- Select your filing status by checking the appropriate box. You may choose from options such as single, married filing jointly, or head of household.

- Indicate whether you have filed a federal extension by checking the corresponding box.

- Complete the income section by entering all relevant income amounts from your W-2s and 1099s. Attach any necessary documents as specified.

- Calculate your personal credits by checking the relevant boxes for yourself and your spouse if applicable, noting any dependents and their information.

- Proceed through the further sections of income adjustments, total income and then move on to tax computations while following the instructions for entering deductions.

- Fill in the total payments, overpayment, or tax due sections as indicated towards the end of the form.

- Sign the form and include the date and relevant information as required before saving or printing the final document.

Complete your taxation forms online with confidence and ensure timely submission for processing.

It is possible to be resident for tax purposes in more than one country at the same time. This is known as dual residence.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.