Loading

Get Ar1000dc

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ar1000dc online

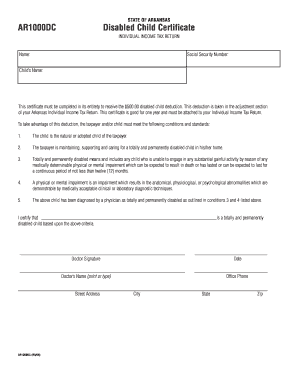

The Ar1000dc form, known as the Disabled Child Certificate, is essential for claiming a $500 deduction for taxpayers supporting a totally and permanently disabled child. Completing this form accurately ensures you can benefit from the tax deduction when filing your Individual Income Tax Return.

Follow the steps to complete and submit the Ar1000dc form online.

- Press the ‘Get Form’ button to access the Ar1000dc document and open it in the appropriate platform.

- In the 'Name' field, input your full name as the taxpayer. This information identifies you as the individual claiming the deduction.

- Next, provide your Social Security Number in the designated field. This number is crucial for tax identification purposes.

- Enter the child’s name in the appropriate section. Ensure this matches the legal name of the disabled child you are claiming the deduction for.

- In the certification statement, you must write the name of the child you are certifying as totally and permanently disabled.

- Have a qualified physician complete the required certification. The doctor must sign, print their name, and provide their office phone number, along with the street address, city, state, and zip code.

- Once all fields are filled in, double-check the information for accuracy. This will help prevent any delays in processing your tax return.

- Finally, save the completed form. You can choose to download, print, or share it according to your filing needs.

Complete the Ar1000dc form online today to ensure you can claim your deduction efficiently.

An Arkansas tax power of attorney form is a state-issued document that can be used to provide a tax attorney with the legal authority to represent a taxpayer in the filing of their income tax return.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.