Loading

Get Direct/automatic Rollover Roth Ira Distribution Request Instructions

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Direct/Automatic Rollover Roth IRA Distribution Request Instructions online

This guide provides you with clear instructions on how to complete the Direct/Automatic Rollover Roth IRA Distribution Request form online. By following these steps, you can ensure that your distribution request is processed efficiently and accurately.

Follow the steps to complete your distribution request form online.

- Press the ‘Get Form’ button to access the Direct/Automatic Rollover Roth IRA Distribution Request form and open it for editing.

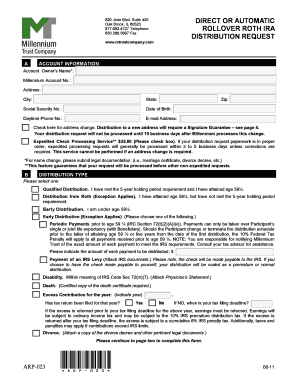

- In Section A, enter your personal information including your name, Millennium Account Number, address, Social Security Number, date of birth, daytime phone number, and email address. If your address has changed, remember that this requires a Signature Guarantee.

- Proceed to Section B and select the type of distribution you are requesting. This includes options like Qualified Distribution, Early Distribution, or declaring an Excess Contribution. Attach any required documentation based on your selection.

- In Section C, specify the amount and method of distribution. If you are closing your account, indicate this by marking 'Total Distribution'. For a partial distribution, denote the amount you wish to distribute and specify which assets to sell if necessary.

- Complete Section D if you have selected Recurring Payments. Indicate the amount, starting date, frequency, and preferred payment method. If choosing bank direct ACH, remember the requirement for a Signature Guarantee.

- In Section E, select how you would like to receive your payment. Ensure all necessary details are filled out, especially if providing a different delivery address or opting for a wire transfer.

- In Section F, make your Federal and State tax withholding elections. Mark the preferred boxes to indicate if you want taxes withheld, and consult with a tax advisor if needed.

- Review Section G for any applicable fees associated with your request.

- In Section H, provide your signature and the date. Ensure you attach any required documentation such as a driver’s license, legal change of name documents, or additional information as requested.

- Finally, submit your completed form along with any necessary documentation to Millennium Trust via mail, email, or fax. Check for any requirements for a Signature Guarantee and take note of submission methods.

Complete your Direct/Automatic Rollover Roth IRA Distribution Request online today to ensure prompt processing.

Regardless of your age, you will need to file a Form 1040 and show the amount of the IRA withdrawal. Since you took the withdrawal before you reached age 59 1/2, unless you met one of the exceptions, you will need to pay an additional 10% tax on early distributions on your Form 1040.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.