Loading

Get Crt 587 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Crt 587 Form online

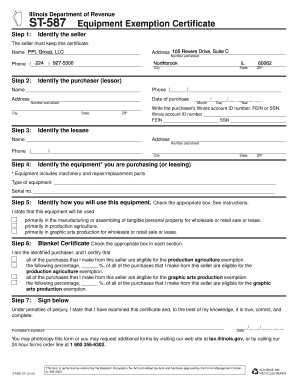

Filling out the Crt 587 Form online can be a straightforward process with the right guidance. This comprehensive guide offers step-by-step instructions tailored to your needs, ensuring a smooth experience as you submit your Equipment Exemption Certificate.

Follow the steps to successfully complete the Crt 587 Form online.

- Click ‘Get Form’ button to obtain the form and open it in the editing interface.

- Identify the seller by providing their name, address, and phone number as requested. Ensure that this information is accurate, as the seller must keep this certificate.

- Identify the purchaser (lessor) by entering their name, address, phone number, and the date of purchase. Include the purchaser's Illinois account ID number, FEIN, or SSN.

- If applicable, identify the lessee by providing their name, address, and phone number.

- Identify the equipment you are purchasing (or leasing) by entering the type of equipment and its serial number.

- Specify how you will use the equipment by checking the appropriate box according to its primary use in manufacturing, agriculture, or graphic arts.

- If using as a blanket certificate, check the appropriate box indicating either all or a specific percentage of purchases that are exempt.

- Sign and date the form, confirming the information is true and complete to the best of your knowledge.

- Finalize the submission by saving changes, downloading, printing, or sharing the completed form as needed.

Start filling out your Crt 587 Form online today to ensure a hassle-free experience!

A pass-through entity should use Form 592 if: It is reporting withholding from payments made to domestic nonresident independent contractors or domestic nonresident recipients of rents, endorsement income, or royalties.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.