Loading

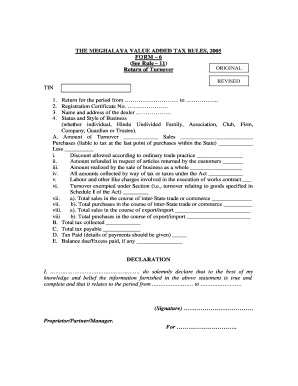

Get The Meghalaya Value Added Tax Rules, 2005 Form 6 ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out THE MEGHALAYA VALUE ADDED TAX RULES, 2005 FORM 6 online

Filling out THE MEGHALAYA VALUE ADDED TAX RULES, 2005 FORM 6 is an essential process for dealers to report their turnover and comply with tax regulations. This guide will provide you with detailed, step-by-step instructions to complete this form accurately and efficiently online.

Follow the steps to fill out the form correctly.

- Press the ‘Get Form’ button to access the form and open it in your chosen editor.

- Enter your Taxpayer Identification Number (TIN) in the designated field.

- Fill in the return period, specifying the start and end dates for the reporting period.

- Input your Registration Certificate Number in the provided space.

- Provide your name and address as the dealer, ensuring all details are complete.

- Indicate the status and style of your business, selecting from options such as individual, firm, association, etc.

- Document the amount of turnover and detailed sales and purchases, outlining each category as instructed in the form.

- Calculate total tax collected and total tax payable, ensuring all figures are accurate.

- Fill in the declaration section with your name, confirming the information is true to the best of your knowledge.

- Sign the form as the proprietor, partner, or manager, adding the date and any relevant details.

- Review all entries for accuracy, then save changes, download, print, or share the completed form as necessary.

Complete your documents online to ensure timely and accurate reporting.

General VAT Rate For goods like liquor, cigarettes etc. many governments charge high VAT rates of 12.5% or 14-15%. Also, many state governments follow a general rate of VAT for goods which cannot be categorized to suit the above classification. Such goods are taxed at 12%, 13% or even 15% in different states.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.