Loading

Get Form 709 - Allindiantaxes

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 709 - Allindiantaxes online

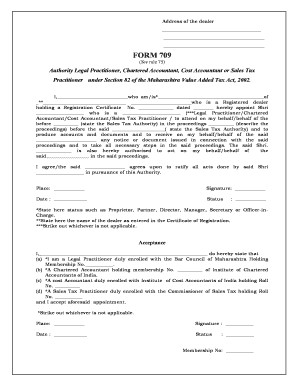

Filling out Form 709 - Allindiantaxes online can seem daunting, but with clear guidance, you can complete it confidently. This form is essential for individuals looking to authorize a representative for sales tax proceedings, ensuring that all necessary information is accurately captured.

Follow the steps to successfully fill out the Form 709 online.

- Click ‘Get Form’ button to obtain the form and open it for editing.

- In the first section, provide your name as the person who is completing the form. Ensure it matches the name on your registration certificate.

- Specify your role or status (e.g., Proprietor, Partner) in the business. This information is critical for the authority to identify your position.

- Fill in the name of the registered dealer exactly as it appears in your Registration Certificate.

- Enter the Registration Certificate number along with the date it was issued, ensuring accuracy to avoid any issues.

- Designate a representative by entering their name, role (like Legal Practitioner, Chartered Accountant), and authority to act on your behalf.

- Clearly state the Sales Tax Authority with which the proceedings will take place, ensuring that this aligns with the documentation you have.

- Describe the proceedings briefly to inform the authority about the nature of the case.

- Review the authority granted to your representative and the agreement to ratify their actions on your behalf.

- Sign and date the form at the designated space, confirming the information provided.

- In the acceptance section, have your representative provide their information and signature, indicating their acceptance of this appointment.

- Once all information is filled out accurately, save your changes. You can then download the form, print it, or share it as needed.

Start filling out your Form 709 - Allindiantaxes online today to ensure timely submission and compliance.

Related links form

Form 709 is an annual return that is due by April 15 of the year after the gift was made. While this is the same deadline as the individual income tax return (Form 1040), the gift tax return must be filed separately.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.