Loading

Get Vat 57

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Vat 57 online

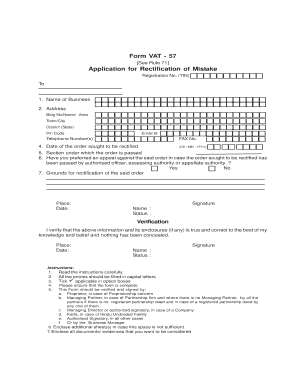

Filling out the Vat 57 form online can seem challenging, but this guide will simplify the process for you. By following the steps outlined below, you will be able to complete your application for rectification of a mistake efficiently.

Follow the steps to complete your Vat 57 application online.

- Use the ‘Get Form’ button to access the Vat 57 document and open it in your preferred editor.

- Begin by entering your registration number (Tax Identification Number). Ensure that this number is accurate to avoid discrepancies in your application.

- Fill in the name of your business in the designated section. This should be the official name registered with the relevant authorities.

- Provide the complete address of your business, including building number/name, area, town/city, district, and pin code. This information is vital for correspondence.

- Enter a valid email address where you can be reached for further communication regarding your application.

- List your telephone number(s) and fax number, ensuring that these are current for any follow-up needed.

- Indicate the date of the order that you seek to rectify in the format DD/MM/YYYY to ensure clarity.

- Specify the section under which the order was passed. This should reflect the relevant legal reference to support your application.

- Confirm whether you have preferred an appeal against the order by selecting ‘Yes’ or ‘No’. This helps in processing your application accurately.

- Provide the grounds for rectification of the order in detail. This section is crucial as it outlines your reasoning for requesting changes.

- Sign the application and include your name and status in the designated fields. This must reflect your authority to submit the application.

- In the verification section, confirm that all information provided is true and correct. Sign and date this section to finalize your application.

- Review your form to ensure all entries are filled in capital letters and that any option boxes are ticked as applicable.

- If additional space is required for your answers, attach an extra sheet and enclose any necessary documents or evidence to support your application.

- Once you have completed the form, you can save your changes, download it, or print it for submission.

Start completing your Vat 57 application online today to ensure your rectification request is processed efficiently.

A tax on imported goods, paid in addition to other duties due. It is called a "value-added" tax because it is applied throughout the supply chain - on everything from the point of raw materials up to manufacturing and retail.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.