Loading

Get Ctca 047 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ctca 047 Form online

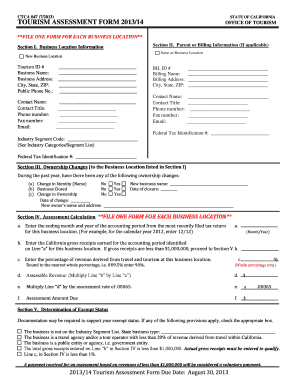

The Ctca 047 Form is essential for businesses in California to report their tourism-related revenue and ensure compliance with state assessment requirements. This guide provides clear, step-by-step instructions on how to fill out the Ctca 047 Form online, making the process straightforward and accessible for all users.

Follow the steps to complete the Ctca 047 Form online.

- Press the ‘Get Form’ button to access the form and open it in your preferred browser.

- Fill in Section I with your business location information, including Tourism ID number, business name, address, public phone number, and contact details.

- If applicable, complete Section II with the parent or billing information, including billing name and address. Ensure all contact details are included.

- In Section III, indicate if there have been any ownership changes to the business location listed in Section I. Provide any new business name, closure date, or new owner's information if relevant.

- Proceed to Section IV to calculate your assessment. Enter the ending month and year of your accounting period, gross receipts amount, and the percentage of revenue from travel and tourism.

- Complete the assessment calculation by multiplying the gross receipts by the percentage of revenue derived from tourism, and then multiply by the assessment rate to determine the amount due.

- In Section V, determine if your business meets the exempt status criteria by checking the appropriate boxes and providing the necessary information.

- Section VI is optional. If you wish, indicate your choice to pay the maximum assessment fee.

- In Section VII, certify that the information provided is accurate by signing and dating the form.

- If you have opted to receive marketing material, fill out Section VIII with the relevant contact information.

- Once you have completed all sections, save your changes. You may download, print, or share the form as needed.

Complete your Ctca 047 Form online today to ensure compliance and contribute to California's tourism assessment program.

Funding of the organization is through taxes (known as assessments) on tourism related businesses, such as hotels.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.