Loading

Get Loan Application - Cuna Mutual Group

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

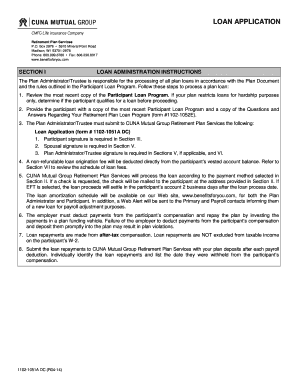

How to fill out the LOAN APPLICATION - CUNA Mutual Group online

This guide provides a comprehensive overview of the LOAN APPLICATION - CUNA Mutual Group, designed to assist users in filling out the form accurately and efficiently. Whether you are a first-time applicant or familiar with loan applications, this step-by-step guide will help you navigate each section with ease.

Follow the steps to complete your loan application successfully.

- Click ‘Get Form’ button to obtain the form and open it in your preferred online document editor.

- Begin filling out SECTION II: LOAN APPLICATION. Enter your name, address, and Social Security Number accurately. Ensure all details are correct to avoid delays in processing.

- Select your payment method by checking either 'Check' or 'EFT'. If you choose EFT, provide the necessary information such as ABA Routing Number, account number, and type.

- In section A, indicate the loan amount you wish to request. Make sure this amount complies with the general loan limit.

- Complete section B by specifying the loan term and whether the loan will be used for purchasing your principal residence. Select the appropriate payroll deduction repayment schedule.

- Proceed to SECTION III, where both the participant and Plan Administrator/Trustee must understand and agree to the loan terms. The participant must sign and date the section.

- If married, fill out SECTION IV and V for marital status and spousal consent. Ensure your spouse consents to the loan and provide their signature and witness as required.

- Complete SECTION VI: LOAN AUTHORIZATION, where the Plan Administrator/Trustee will authorize CUNA Mutual Group to process the loan. Ensure to date this section.

- Finally, review SECTION VII: LOAN FEES to understand any applicable fees which will be deducted from your account. Take note of the fee schedule for different loan terms.

- Once all sections are completed, save your changes. You may choose to download, print, or share the completed form as needed.

Complete your LOAN APPLICATION - CUNA Mutual Group online today.

Most credit unions and some banks use “Loanliner” documents. These agreements are standard loan documents developed by CUNA Mutual Group and sold to financial institutions. Over 70% of all credit unions use Loanliner documents for their lending transactions.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.