Loading

Get How To Fill Refund Adjustment Order Under Form Vat G9

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the How To Fill Refund Adjustment Order Under Form Vat G9 online

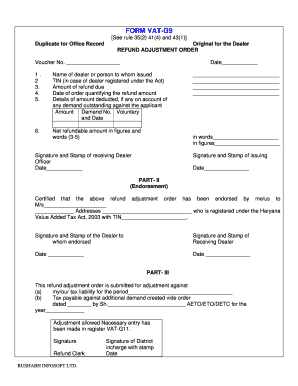

Filling out the Refund Adjustment Order under Form Vat G9 is a crucial process for requesting refunds efficiently. This guide provides clear, step-by-step instructions to assist users in completing the form accurately and effectively online.

Follow the steps to complete the refund adjustment order form

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In the 'Voucher No.' field, enter the unique identifier for your refund adjustment order. This number helps track your request within the system.

- Fill in the 'Date' field with the date you are completing the form. Ensure that this date is current and accurate.

- Provide the 'Name of dealer or person to whom issued' in the designated field. This should be the name of the entity that is eligible for the refund.

- Enter the 'TIN' (Tax Identification Number) for the dealer registered under the relevant tax act in the specified section.

- Specify the 'Amount of refund due' clearly in the appropriate field. This amount should reflect the total refund you are claiming.

- Complete the 'Date of order quantifying the refund amount' by entering the date of the order that specifies your entitled refund.

- If applicable, provide 'Details of amount deducted' in the relevant field, particularly if there are any outstanding demands against your application.

- In the section for 'Net refundable amount in figures and words', accurately state the amount in both numerical and written form for clarity.

- Securely affix the 'Signature and Stamp of receiving Dealer' and the 'Signature and Stamp of issuing Officer' in the designated areas.

- In 'PART-II', certify the endorsement by entering the dealer's name and their TIN, and include the necessary signatures and stamps.

- Complete 'PART-III' by detailing the tax period for which the refund is applicable and providing any additional details regarding tax liabilities.

- Finally, you can save changes to your form, download it for your records, print it for submission, or share it as needed.

Start filling out your refund adjustment order online today for a seamless process.

0:00 4:10 How to convert an excel document to fillable pdf form in adobe ... - YouTube YouTube Start of suggested clip End of suggested clip And automatically open our pdf form okay and click right side menu option select prepare from clickMoreAnd automatically open our pdf form okay and click right side menu option select prepare from click here and get restart.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.