Loading

Get Mw507 Calculator

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Mw507 Calculator online

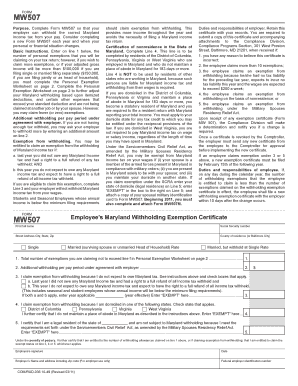

The Mw507 Calculator is an essential tool for ensuring correct Maryland income tax withholding from your pay. By accurately completing this form, you can help your employer withhold the appropriate amount of taxes based on your financial situation.

Follow the steps to effectively complete the Mw507 Calculator.

- Press the ‘Get Form’ button to access the Mw507 Calculator and open it in your preferred editing tool.

- Enter your full name in the designated field at the top of the form.

- Provide your street address, city, state, and zip code in the specified fields.

- Fill in your Social Security number for identification purposes.

- Indicate your county of residence or if you reside in Baltimore City.

- Select your filing status by checking the appropriate box: 'Single,' 'Married (surviving spouse or unmarried Head of Household),' or 'Married, but withhold at Single Rate.'

- On line 1, enter the total number of personal exemptions you are claiming on your tax return. If necessary, complete the Personal Exemption Worksheet on page 2 for accurate calculations.

- If you require additional withholding, enter the specified amount on line 2.

- To claim an exemption from withholding, ensure you meet the criteria and complete line 3, checking all relevant boxes.

- If you are a nonresident or qualifying under the Servicemembers Civil Relief Act, complete lines 4 and 5 as applicable.

- Review your entries to ensure accuracy before signing and dating the form.

- Once completed, you can save changes, download a copy, print the form, or share it with your employer.

Start completing your Mw507 Calculator online today to ensure correct tax withholding!

The Maryland Form MW 507, Employee's Maryland Withholding Exemption Certificate, must be completed so that you know how much state income tax to withhold from your new employee's wages.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.