Loading

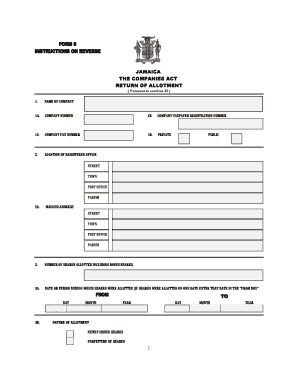

Get Jamaica The Companies Act Return Of Allotment ( Pursuant To Sections 52 ) 1

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the JAMAICA THE COMPANIES ACT RETURN OF ALLOTMENT (Pursuant to Sections 52) 1 online

Filling out the Jamaica Companies Act Return of Allotment form is an essential process for companies issuing shares. This guide provides detailed, step-by-step instructions to assist users, regardless of their legal experience, in completing the form accurately and efficiently online.

Follow the steps to fill out the return of allotment form online.

- Click ‘Get Form’ button to obtain the form and access it in the online editor.

- In the first section (1), enter the full legal name of the company as it appears in official records.

- In section 1A, input the company number assigned by the Registrar of Companies.

- For 1B, provide the Company Taxpayer Registration Number. If you do not have the original card, ensure that a certified copy is available.

- Enter any applicable company fax number in section 1C and indicate in section 1D whether the company is private or public.

- In section 2, detail the full address of the registered office, ensuring you include street, town, parish, and avoid using a post office box.

- Section 2A allows for the mailing address to be indicated. If it is the same as the registered office, state ‘SAME AS ABOVE AT ITEM 2’.

- State the number of shares allotted, including bonus shares, in section 3.

- In section 3A, specify the date or period during which shares were allotted.

- Indicate in section 3B whether the shares are newly issued or a result of forfeiture.

- If applicable, provide details of forfeiture in section 3C, including the name and number of shares forfeited.

- In section 4, list the number of shares allotted, the class of shares, and the value for each share.

- Section 4A requires you to mention if the shares were allotted for consideration other than cash.

- In section 4B, specify the amount treated as paid up for each share.

- In sections 5 and 5A, indicate any non-cash considerations for the shares allotted.

- In section 6, input the names, occupations, and addresses of allottees along with the details of shares allotted to them.

- Have a director, secretary, or authorized official sign and date the form in section 7.

- Provide the contact information of the person filing the form in section 8.

- In section 9, list the names, email addresses, and Taxpayer Registration Numbers of each director.

- Finally, review the completed form for accuracy before saving changes or opting to download, print, or share the form.

Complete your return of allotment form online today for efficient processing.

52. Service of documents on Registrar. A document may be served on a Registrar by sending it to him at,, his office by post, under a certificate of posting or by registered post,' or by delivering it to or leaving it for, him at his office.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.