Loading

Get Oregon Change In Status Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Oregon Change In Status Form online

Filling out the Oregon Change In Status Form online is a straightforward process that allows users to update their business and employment information efficiently. This guide provides step-by-step instructions to ensure you complete the form accurately and effectively.

Follow the steps to complete the online Oregon Change In Status Form.

- Click the ‘Get Form’ button to access the Oregon Change In Status Form, which you can then download and open for editing.

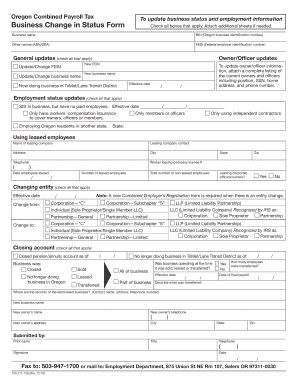

- Begin with the business information section. Enter your business name, Oregon business identification number (BIN), and any other names such as your Assumed Business Name (ABN) or Doing Business As (DBA) name. Also, include your Federal Employer Identification Number (FEIN).

- Proceed to the general updates section. Check all applicable boxes to indicate the type of updates you are making. If there are changes to ownership or officer information, ensure to attach a complete listing of current owners and officers, including their positions, Social Security Numbers (SSN), home addresses, and phone numbers.

- Fill in the employment status updates. Check all relevant boxes to indicate whether you are still in business without paid employees, have workers’ compensation insurance, or use independent contractors. Provide the effective date for each change.

- In the changing entity section, indicate any changes to your business structure. Specify the effective date and check the boxes reflecting your previous and current business entity types.

- Complete the closing account section if applicable. Check any boxes that apply to your situation, for instance, if you have closed a pension/annuity account or are no longer doing business in the TriMet/Lane Transit District.

- Lastly, provide your contact information in the submitted by section. This includes your printed name, signature, title, phone number, and the date.

- Once completed, review the form for accuracy, then save your changes. You can choose to download, print, or share the form as needed. Ensure to follow the submission instructions provided at the end of the form.

Complete your Oregon Change In Status Form online today for a hassle-free update to your business information.

Related links form

Withhold the mandatory 8 percent Oregon state tax. Note: 8 percent withholding is mandatory for certain qualifying distributions unless you elect a direct transfer rollover to a traditional IRA or other eligible employer plan.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.