Loading

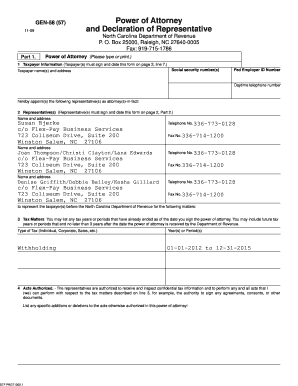

Get North Carolina Department Of Revenue Power Of Attorney 2848 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the North Carolina Department Of Revenue Power Of Attorney 2848 Form online

Completing the North Carolina Power Of Attorney 2848 Form online is a straightforward process. This guide will help you navigate through each section and field, ensuring that you accurately provide the necessary information to authorize your chosen representative.

Follow the steps to fill out the form effectively.

- Click ‘Get Form’ button to obtain the form and open it in your preferred editing tool.

- Begin with Part 1, which covers the taxpayer information. Provide your name, address, social security number, federal employer ID number, and daytime telephone number. Ensure that the information is accurate, as it will be used for correspondence.

- In the Representative section, list the individuals you are appointing as representatives. Include their names, addresses, and contact information. Each representative must also sign and date the form.

- Specify the tax matters for which you are granting authority to your representatives. You can include past tax years or periods and future years that do not exceed three years from the date of filing.

- Indicate the acts authorized. Your representatives will have the authority to receive and inspect confidential tax information and perform any actions you could do regarding the specified tax matters. If there are any specific limitations or additions, indicate them clearly.

- If applicable, check the box indicating that your representative may create an e-Business Center account for online services. This allows them to file returns, pay taxes, and manage tax information on your behalf.

- For the Retention/Revocation of Prior Powers of Attorney, note that submitting this form will revoke earlier powers for the same matters unless you wish to retain them. If so, attach the previous power of attorney.

- Signature of taxpayer(s) is required in Part 1. If you're filing jointly, both partners must sign. Ensure you date the form and include any titles if applicable.

- Move to Part 2, the Declaration of Representative. The representative must sign and date this section, affirming their authority to act on your behalf. They should choose their designation from the options provided and include their state or enrollment card number.

- Once all fields are completed, save your changes. You can then download, print, or share the completed form as needed.

Start completing your forms online today and empower your representative to assist you with your tax matters.

“Wet” ink signatures are needed in order to fax or mail the Form 2848 to the IRS.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.