Loading

Get Simple Ira Deferral Agreement

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SIMPLE IRA Deferral Agreement online

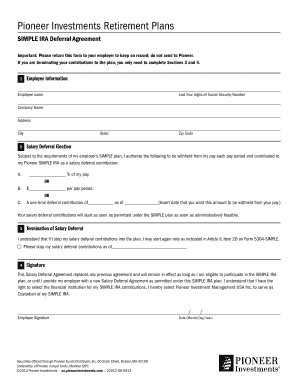

The SIMPLE IRA Deferral Agreement is an essential document that allows employees to defer a portion of their salary into a retirement account. This guide provides step-by-step instructions to assist users in completing the form accurately and efficiently online.

Follow the steps to complete your SIMPLE IRA Deferral Agreement

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by filling out the employee information section. Enter your full name, the last four digits of your Social Security Number, and your company name. Next, provide your address, including the city, state, and zip code.

- In the Salary Deferral Election section, indicate your desired contribution amount. You can choose to specify a percentage of your pay, a fixed dollar amount per pay period, or a one-time deferral contribution with the date you wish it to start.

- If you wish to terminate your salary deferral contributions, fill in the indicated date in the Termination of Salary Deferral section.

- Sign the form in the designated place and enter the date of your signature. This agreement replaces any previous salary deferral agreements and confirms your understanding of the contributions.

- Once you have completed all sections, check your information for accuracy. You can then save your changes, download the document for your records, print it, or share it as required.

Complete your SIMPLE IRA Deferral Agreement online today to ensure your retirement savings are on track.

Pro tip: Contributions to a SIMPLE IRA are not subject to a maximum age requirement. For example, an individual who is still employed after age 72 (70½ if the employee reached age 70½ before January 1, 2020) can continue to make SIMPLE IRA contributions.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.