Loading

Get State, Local, And District Sales And Use Tax Return - Justia

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the State, Local, And District Sales And Use Tax Return - Justia online

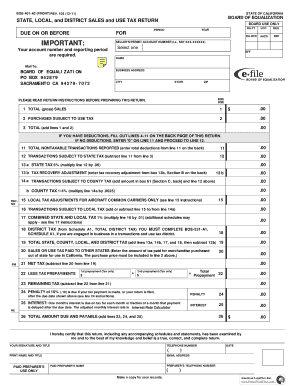

Filling out the State, Local, and District Sales and Use Tax Return is essential for ensuring compliance with California tax regulations. This guide provides clear steps to assist you in completing the online form efficiently.

Follow the steps to accurately complete your tax return.

- Click ‘Get Form’ button to obtain the form and open it in your preferred editor.

- Enter your seller's permit account number in the designated field along with the name and business address.

- Complete section for total gross sales. Enter the total sales amount in line 1.

- Indicate any purchases subject to use tax in line 2.

- Calculate the total sales by adding lines 1 and 2. If you have deductions, continue to fill out the appropriate deductions on the back page.

- If you have deductions, total them in line 11 and subtract this from line 3 to find transactions subject to state tax on line 12.

- Calculate state tax by multiplying the amount on line 12 by 0.06 and enter it on line 13a.

- Complete sections for county tax and local tax adjustments as applicable, following the calculations outlined in the form.

- Enter any additional taxes, such as district tax from Schedule A1, and calculate the total amount due.

- Review all entries for accuracy, then save changes, download, print, or share your completed form according to your needs.

Ensure compliance by completing your State, Local, And District Sales And Use Tax Return easily online.

You owe use tax on any item purchased for use in a trade or business and you are not registered, or required to be registered with the CDTFA to report sales or use tax. You owe use tax on purchases of individual items with a purchase price of $1,000 or more each.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.