Loading

Get Form 4011

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 4011 online

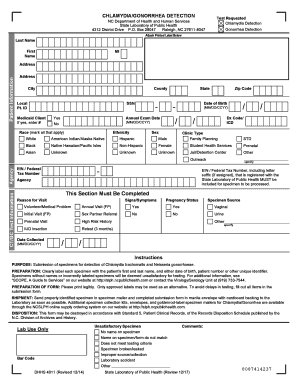

Filling out the Form 4011 is an important step in submitting specimens for the detection of Chlamydia and Gonorrhea. This guide will provide you with clear instructions to ensure that you complete the form accurately and efficiently.

Follow the steps to fill out the Form 4011 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering the patient's last name, first name, and middle initial in the designated fields. Ensure that this information matches the identification on the specimen.

- Complete the patient information section with the full address, including city, county, state, and zip code. This is crucial for proper identification and communication.

- Fill in the patient identifier (Pt. ID) and social security number (SSN) as required. If the patient is a Medicaid client, indicate this by marking 'Yes' and entering the Medicaid number.

- Select the race and ethnicity by checking all applicable boxes in this section. Accurate demographic data is essential for reporting and statistical purposes.

- Provide the date of birth in the specified format (MM/DD/YYYY) and select the patient's sex by marking the appropriate box.

- Indicate the type of clinic, selecting the appropriate options such as family planning, student health services, or prenatal care.

- In the CT/GC test information section, include the appropriate DX Code/ICD and specify any necessary details.

- Complete the reason for the visit, including any signs or symptoms, pregnancy status, and specimen source (e.g., urine or vaginal). This information guides testing decisions.

- Record the date collected for the specimen following the required format (MM/DD/YYYY).

- Review the entire form for accuracy, ensuring all items are filled out legibly to avoid any potential delays in testing.

- Finally, save your changes, and download or print the completed form to submit it alongside the specimen. Ensure the specimen is labeled correctly before shipping.

Start completing your Form 4011 online now to ensure timely testing.

The IRS limits the foreign tax credit you can claim to the lesser of the amount of foreign taxes paid or the U.S. tax liability on the foreign income. For example, if you paid $350 of foreign taxes and owed $250 of U.S. taxes on that same income, your tax credit will be limited to $250.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.