Loading

Get Canada Customs Invoice Facture Des Douanes Bb - Pf Collins

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Canada Customs Invoice Facture Des Douanes Bb - PF Collins online

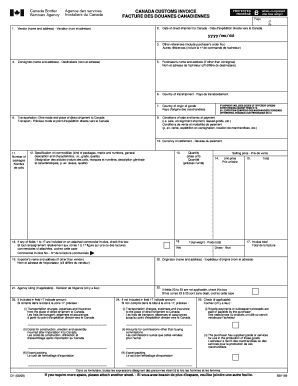

Filling out the Canada Customs Invoice is crucial for ensuring that your shipments comply with customs regulations. This guide will help you navigate each section of the form, providing clear instructions to facilitate your online completion.

Follow the steps to efficiently fill out the form.

- Click ‘Get Form’ button to obtain the form and open it for editing.

- Fill in the vendor's name and address in the designated field to identify the seller of the goods.

- Provide the date of direct shipment to Canada in the specified format (yyyy/mm/dd) to document when the goods were shipped.

- Enter the consignee's name and address to indicate where the goods will be delivered.

- Specify the mode and place of transportation to detail how and from where the goods were shipped to Canada.

- Fill in any additional references, such as the purchaser's order number, to help identify the transaction.

- If the purchaser differs from the consignee, provide their name and address in the appropriate section.

- Indicate the country of transshipment and the country of origin of the goods to comply with import regulations.

- Summarize the conditions of sale and terms of payment, which might include types such as sale or consignment.

- Note the currency of settlement to clarify the monetary terms of the transaction.

- Input the number of packages to account for all items shipped.

- Describe the commodities, including package types, marks, numbers, and general characteristics like grade and quality.

- Specify the quantity of goods and the unit of measurement in the appropriate fields.

- Provide the selling price and unit price for the items being shipped to give a clear understanding of the transaction value.

- Fill in the total weight, differentiating between net and gross weight as needed.

- If applicable, check the box indicating if all relevant information is found on an attached commercial invoice.

- If necessary, complete fields relating to transportation charges and insurance, noting amounts for specific costs.

- Confirm any applicable royalties or payments that pertain to the transaction.

- Once all fields are completed, save the changes made to the form. Users can then choose to download, print, or share the invoice as required.

Complete your Canada Customs Invoice online to ensure accuracy and compliance with customs requirements.

Canada Customs Invoices or commercial invoices containing all the CCI data, are required when: the value of the goods is CA $1,600 or more; the value of Canadian goods being returned has been increased by CA $1,600 or more; the goods are not unconditionally duty-free regardless of end-use or value.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.