Loading

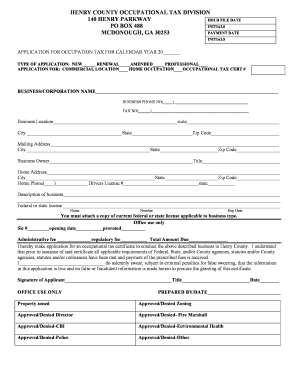

Get Henry County Occupational Tax

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Henry County Occupational Tax online

Filling out the Henry County Occupational Tax form is a crucial step for individuals and businesses looking to operate legally within the county. This guide will provide you with step-by-step instructions to ensure that you complete the form accurately and efficiently.

Follow the steps to successfully complete the occupational tax application.

- Click ‘Get Form’ button to obtain the form and open it for editing.

- Select the type of application you are submitting. Indicate whether it is a new application, renewal, amended application, or professional registration by marking the corresponding checkbox.

- Specify the application for your business. Select either 'commercial location' or 'home occupation' and include your occupational tax certificate number if you have one.

- Enter your business or corporation name in the designated field, followed by your business phone number and fax number.

- Fill in the business location details, including the address, suite number (if applicable), city, state, and zip code.

- Provide your mailing address, ensuring it includes the necessary details like city, state, and zip code.

- Input the name of the business owner along with their title. Then, fill in the owner's home address, including city, state, and zip code.

- Include the home phone number and driver's license number of the business owner, along with the issuing state.

- Describe the nature of your business, providing enough detail to convey its purpose and operations.

- If applicable, provide information on any federal or state licenses your business holds, including the license name, number, and expiration date.

- Remember to attach a copy of the current federal or state license that is applicable to your business type.

- Review the section marked 'Office Use Only' for administrative purposes, which will be completed by the relevant authorities.

- Read the declaration statement carefully, ensuring that all information provided is true. Sign the application, include your title, and date it.

- After verifying that all sections are complete and accurate, save your changes. You may choose to download, print, or share the completed form as necessary.

Complete your Henry County Occupational Tax application online today!

What is the sales tax rate in Henry County? The minimum combined 2023 sales tax rate for Henry County, Georgia is 8%. This is the total of state and county sales tax rates. The Georgia state sales tax rate is currently 4%.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.