Loading

Get General Information For Preparing Employer39s Occupational Tax Returns

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the General Information For Preparing Employer's Occupational Tax Returns online

This guide provides comprehensive and user-friendly instructions for completing the General Information For Preparing Employer's Occupational Tax Returns online. Designed for users of all experience levels, this guide ensures that the process is clear and straightforward.

Follow the steps to accurately complete the form.

- Click ‘Get Form’ button to obtain the form and open it in your chosen editor.

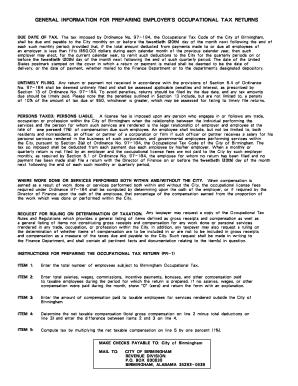

- Enter the total number of employees subject to the Birmingham Occupational Tax in Item 1 of the form. Ensure this number is accurate as it directly affects your tax obligations.

- In Item 2, provide the total salaries, wages, commissions, incentive payments, bonuses, and any other compensation paid to taxable employees during the reporting month. If no payments were made, enter '0' and include an explanation.

- For Item 3, list the total amount of compensation paid to taxable employees for services rendered outside the City of Birmingham. This should reflect only non-taxable earnings.

- Calculate the net taxable compensation for Item 4 by subtracting the amount in Item 3 from the amount in Item 2. Enter this net amount to determine what is subject to tax.

- In Item 5, compute the tax owed by multiplying the net taxable compensation from Item 4 by 1%. This amount is the total tax to be withheld for the month.

- Review your entries for accuracy. Sign and date the form to certify the information provided is correct. Prepare to submit the completed return by the due date.

- You can save the changes, download, print, or share the completed form as necessary. Make sure the payment, if applicable, is prepared in accordance with the instructions provided.

Complete your Employer's Occupational Tax Returns online today to ensure timely filing and avoid any penalties.

In general, 401(k) contributions are not considered taxable income. This means you don't need to report 401(k) on your tax return. However, there are exceptions to this rule. If you take any distributions from your 401(k), you are legally required to report that on your tax return.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.