Loading

Get Fulfill Form No 15g See Rule 26 C

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Fulfill Form No 15g See Rule 26 C online

This guide provides a straightforward approach to completing the Fulfill Form No 15g See Rule 26 C online. By following these steps, users can ensure they accurately fill out the required information without hassle.

Follow the steps to successfully complete the form online:

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by filling out your personal details, ensuring all information is accurate. This typically includes your name, address, and other identifying details.

- Next, identify the income streams relevant to the application, such as salary, interest on securities, or insurance commission. Mark the applicable options.

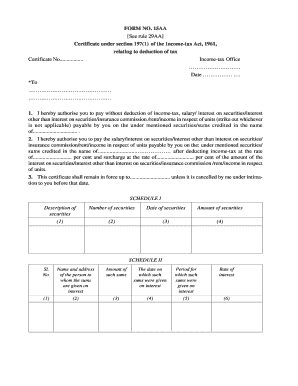

- In the appropriate sections, fill out the details of the securities or sums credited to your name, including their description, number, and amounts.

- Complete Schedule I by listing the details of securities you hold, including the number and date of each security.

- Fill out Schedule II with the necessary information concerning the persons to whom the sums are given on interest.

- Continue to Schedule III, providing details on insurance commissions, if applicable.

- If relevant, complete Schedule IV regarding salaries, detailing the names and addresses of those responsible for payment.

- Proceed to Schedule V for information on rental income, indicating the detail required.

- Finally, verify all entries for accuracy, ensuring adherence to the tax deduction rules. Once complete, you can save the changes, download, print, or share the form.

Complete your documents online effortlessly today.

Eligibility Criteria For Submitting Form 15G Your age must be below 60 years. The total tax liability calculated on your total taxable income for the applicable Financial Year is zero. The total interest earned is less than the basic exemption limit, i.e., less than ₹2.5 lakh.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.