Loading

Get Form St 206 - The Comptroller Of Maryland

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form ST 206 - The Comptroller Of Maryland online

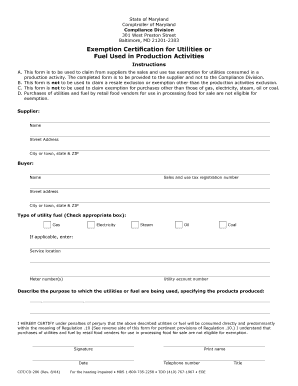

This guide provides clear instructions on filling out Form ST 206, which is used to claim a sales and use tax exemption for utilities consumed in production activities. Following these steps will help ensure that you complete the form accurately and efficiently.

Follow the steps to fill out Form ST 206 correctly

- Press the ‘Get Form’ button to access the form and open it for editing.

- Begin by entering the supplier's name, street address, city or town, state, and ZIP code in the designated fields.

- Next, identify yourself as the buyer by filling in your name along with your sales and use tax registration number, street address, city or town, state, and ZIP code.

- Indicate the type of utility fuel you are claiming an exemption for by checking the appropriate box for gas, electricity, steam, oil, or coal.

- If applicable, please enter the service location, meter number(s), and utility account number as required.

- Describe the purpose for which the utilities or fuel are being utilized. Be specific about the products you are producing.

- Finally, certify the information by signing and printing your name, along with the date and telephone number. Include your title if necessary.

- Once everything is complete, ensure you save any changes before downloading, printing, or sharing the form.

Complete your documents online for a smooth filing experience.

Exemptions and Deductions There have been no changes affecting personal exemptions on the Maryland returns. Personal Exemption Amount - The exemption amount of $3,200 begins to be phased out if your federal adjusted gross income is more than $100,000 ($150,000 for joint taxpayers).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.