Loading

Get How To File Galion City Taxes Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the How To File Galion City Taxes Form online

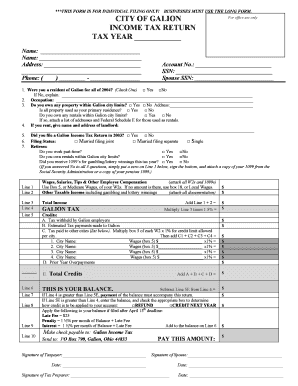

Filing taxes can be a straightforward process when you have clear guidance. This guide will walk you through the steps to complete the How To File Galion City Taxes Form online, ensuring that you understand each section and field.

Follow the steps to successfully complete your tax form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your personal information. Fill in your name, address, and phone number. Ensure all details are accurate.

- Indicate your residency status during the tax year by checking the appropriate box for whether you were a resident of Galion for the entire year.

- Provide your occupation and detail any property you own within Galion's city limits. If you own rental properties, make sure to include the addresses and necessary attachments.

- Indicate whether you filed a Galion Income Tax Return the previous year and select your filing status.

- Complete the income sections by detailing all relevant earnings, including employee compensation and any other taxable income.

- Calculate your Galion tax by multiplying your total income by 1.5% and document any applicable credits for taxes withheld, estimated payments, or taxes paid to other cities.

- Determine your balance by subtracting your total credits from your calculated Galion tax. Indicate whether you owe tax or if you are entitled to a refund.

- If applicable, include any late fees and penalties for late filings before finalizing your balance.

- Attach all necessary documentation including W-2s and 1099s, sign the form, and prepare for submission.

- Once all information is accurately provided, save changes, and consider downloading, printing, or sharing the form as needed.

File your Galion City taxes online today for a seamless experience.

Individuals always owe municipal income tax to the municipality where they work (this is called “work place tax”), but they may or may not owe income tax to the municipality where they live (this is called “residence tax”). Most individuals have the tax owed where they work automatically withheld by their employer.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.