Loading

Get Nyc Exemption Application For Owners - The Lovett Group Of Real ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NYC Exemption Application For Owners - The Lovett Group Of Real ... online

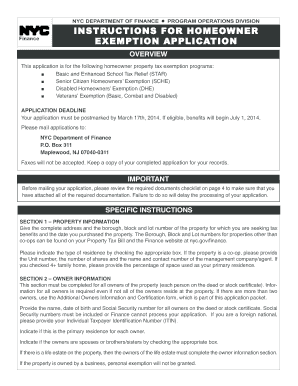

This guide will provide you with clear, step-by-step instructions on how to effectively complete the NYC Exemption Application for Owners online. Whether you are new to tax exemptions or have prior experience, this comprehensive guide will ensure that you navigate the application process successfully.

Follow the steps to complete the online NYC Exemption Application for Owners.

- Press the ‘Get Form’ button to access the application form and open it in your preferred online editor.

- Begin with Section 1, where you will input the complete address of your property, including the borough, block, and lot number. Make sure to provide the date you purchased the property and select your type of residence from the available options.

- Proceed to Section 2, where you must fill in the information for all property owners. This includes their names, dates of birth, and Social Security numbers. Verify if this property serves as their primary residence.

- In Section 3, you will enter income information. Attach relevant documents such as your 2012 federal tax returns or income proofs if filing taxes was not required. Include details regarding any unreimbursed medical or prescription expenses if applicable.

- If applying for senior or enhanced STAR exemptions, navigate to Section 4 to upload proof of age via government-issued ID for owners who will be 65 by the specified date.

- In Section 5, you will confirm if any owners receive disability benefits and upload necessary supporting documents.

- Complete Section 6 by indicating if any owners are veterans and provide copies of required documentation.

- Finalize your application in Section 7 by ensuring all owners sign and date the application, while also providing contact information.

- Review all sections for completeness and accuracy. Save the changes, and download or print the filled form for your records.

Begin the process of filling out your documents online today.

Related links form

The Department of Finance (DOF) administers a number of benefits in the form of tax exemptions, abatements, and money-saving programs. Exemptions lower the amount of tax you owe by reducing your property's assessed value. Abatements reduce your taxes by applying credits to the amount of taxes you owe.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.