Loading

Get Do Not Mail This Form To The Ftb

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the DO NOT MAIL THIS FORM TO THE FTB online

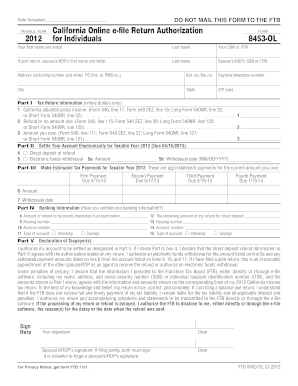

Filling out the DO NOT MAIL THIS FORM TO THE FTB online is an essential step in the California tax filing process for individuals. This guide provides a clear, step-by-step approach to ensure that users can successfully complete this form without difficulties.

Follow the steps to complete the form accurately.

- Click the ‘Get Form’ button to access the document and open it in your online editor.

- Enter your first name and initial in the designated field. Following that, input your last name.

- Provide your social security number (SSN) or individual taxpayer identification number (ITIN). If filing jointly, make sure to also include your spouse's or registered domestic partner's first name, initial, last name, and their SSN or ITIN.

- Complete your address, including the street number and name, any apartment or suite number, city, state, and ZIP code. Ensure that all information is correct to avoid any processing delays.

- In Part I, input the California adjusted gross income as reported on the relevant line of your tax return. Follow the specific line references provided for your applicable form: Form 540, Form 540 2EZ, Long Form 540NR, or Short Form 540NR.

- Indicate whether you expect a refund or if you have no amount due by filling in the appropriate line in Part I, using the corresponding information from your tax form.

- If applicable, state the amount you owe on the designated line in Part I based on the figures from your tax return.

- In Part II, choose your refund delivery method by selecting either direct deposit or electronic funds withdrawal. If selecting electronic funds withdrawal, fill in the amount and the desired withdrawal date.

- For estimated tax payments in Part III, state the amounts due for each payment date, ensuring accuracy in both the amount and dates as outlined.

- Complete the banking information in Part IV. This will involve entering your bank routing number, account number, and selecting the type of account, either checking or savings, for the direct deposit.

- In Part V, read and agree to the declaration statement. This will require your signature, date, and, if applicable, your spouse's or registered domestic partner's signature.

- Once all fields are completed, save your changes. You may also choose to download, print, or share the filled form as needed.

Complete the DO NOT MAIL THIS FORM TO THE FTB online today to ensure timely processing of your tax return.

If FTB or IRS needs to reach a taxpayer to verify a return or discuss a bill, both agencies begin by sending a letter via postal mail. If the taxpayer does not respond, the FTB or IRS may reach out by phone, with courteous agents clearly identifying themselves.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.