Loading

Get Whitley County Kentucky Net Profits License Fee Return

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Whitley County Kentucky net profits license fee return online

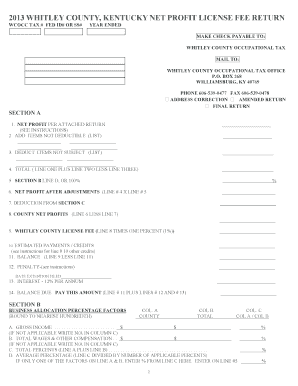

Filling out the Whitley County Kentucky net profits license fee return is an essential task for businesses operating within the county. This guide will provide step-by-step instructions to assist you in completing the form accurately and efficiently online.

Follow the steps to complete your return successfully

- Click ‘Get Form’ button to obtain the form and open it in your preferred online editing tool.

- Identify the tax year for which you are filing the return and enter it at the top of the form.

- Provide your business information, including your WCOCC tax number, Federal ID number or Social Security number, as applicable.

- In Section A, enter the net profit from the attached return on line 1. Ensure that you have included all necessary schedules and documents.

- List any items that are not deductible in line 2. Carefully consider all exclusions and refractions.

- On line 3, deduct items not subject to the tax by listing them in the designated space.

- Calculate the total by adding line 1 and line 2 together, then subtracting line 3. Enter this total on line 4.

- Determine the allocation percentage on line 5. If your business is exclusively in Whitley County, enter 100%. If not, follow the instructions in Section B to calculate this percentage.

- Compute the net profit after adjustments on line 6 using the total from line 4 multiplied by the percentage from line 5.

- Deduct any applicable amounts noted in Section C on line 7, and calculate the county net profits by subtracting this from line 6 to arrive at line 8.

- Calculate the Whitley County license fee on line 9 by multiplying the amount on line 8 by one percent (1%).

- Account for any estimated payments or credits on line 10 and calculate your balance due on line 11 by subtracting line 10 from line 9.

- Review the penalties and interests sections (lines 12 and 13) to ensure compliance and accurate reporting.

- Complete the signature section at the bottom of the form, certifying that your statements are true and correct, and include preparer's information if applicable.

- Once all fields are completed, save your changes, download a copy for your records, and print or share the form as needed.

Complete your Whitley County net profits license fee return online today for a smooth and efficient filing process.

What is the sales tax rate in Mayfield, Kentucky? The minimum combined 2023 sales tax rate for Mayfield, Kentucky is 6%. This is the total of state, county and city sales tax rates.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.