Loading

Get Irs 14950 2015

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 14950 online

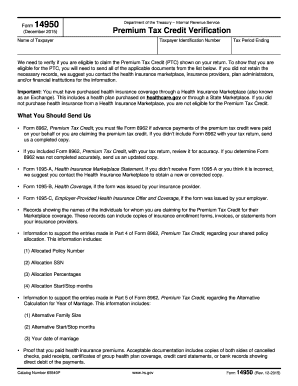

The IRS 14950 form is essential for verifying eligibility for the Premium Tax Credit. This guide provides clear, step-by-step instructions to assist users in completing the form online.

Follow the steps to complete the IRS 14950 form online.

- Click the ‘Get Form’ button to access the IRS 14950 form and open it in your document editor.

- Begin by entering the name of the taxpayer in the designated field. Ensure that the name matches the documentation provided.

- Enter the taxpayer identification number in the appropriate section. This number is crucial for processing the form.

- Input the tax period ending date accurately. This date represents the closing of your tax year.

- Review the list of documents needed to support your Premium Tax Credit claim. Gather and prepare to upload all applicable forms, such as Form 8962, Form 1095-A, and proof of premium payments.

- Ensure that all information within each document is correct and complete. If corrections are needed in Form 8962, prepare an updated copy.

- Once all required fields are filled out and documentation is attached, review the entire form for accuracy.

- Finally, you can save changes, download a copy of the completed form, print it, or share it as necessary.

Complete your IRS 14950 form online today to ensure your Premium Tax Credit eligibility is properly verified.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Using the IRS data retrieval tool can simplify your application process and ensure accuracy when reporting your tax data. It provides direct access to your tax return information, reducing the chance of errors. Therefore, taking advantage of the IRS 14950 makes sense for those looking to streamline their finances.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.