Loading

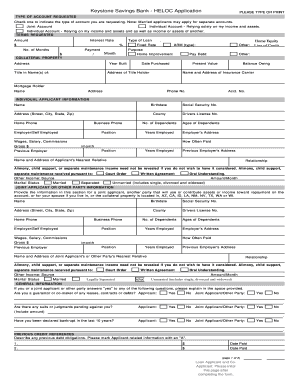

Get Heloc Application - Keystone Savings Bank

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the HELOC Application - Keystone Savings Bank online

Filling out the Home Equity Line of Credit (HELOC) application at Keystone Savings Bank online is a straightforward process. This guide will provide you with step-by-step instructions to ensure that your application is completed accurately and efficiently.

Follow the steps to fill out your HELOC application correctly.

- Press the ‘Get Form’ button to access the HELOC application and open it in your preferred editor.

- Begin by selecting the type of account you are applying for. Choose from 'Joint Account', 'Individual Account - Relying solely on my income and assets', or 'Individual Account - Relying on my income and assets as well as income or assets of another'.

- Fill out the terms requested section. Indicate the amount, interest rate, type of loan, and the number of months for the loan.

- In the collateral property section, provide the property details including the year built, the title holder's information, and the purpose of the loan (e.g., home improvement).

- Enter your individual applicant information, including your name, birthdate, Social Security number, and employment details. Ensure to provide accurate information regarding your dependents.

- If applicable, complete the joint applicant or other party information section with the same level of detail as your own information.

- Answer the general information questions regarding any outstanding debts or previous credit references, providing explanations where necessary.

- List your current assets and outstanding debts in their respective sections, ensuring to include all necessary information and attachments if required.

- Review your completed application for accuracy. Once confirmed, save your changes. You can then download, print, or share the form as needed.

Complete your HELOC application online today to take the next step towards obtaining your home equity line of credit.

A few factors influence the timeline—some in and some out of your control: How well you're prepared. Your lender will want to see copies of your current mortgage statement, property tax bill, and proof of income. If you don't have these readily available, it might take your lender longer to process your application.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.