Loading

Get Ira Distribution Request - Jp Morgan Funds

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRA Distribution Request - JP Morgan Funds online

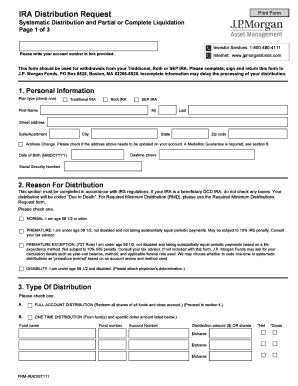

The IRA Distribution Request form for JP Morgan Funds is essential for withdrawing funds from your Traditional, Roth, or SEP IRA. This guide provides clear, step-by-step instructions to help you complete the form accurately and efficiently.

Follow the steps to complete the IRA Distribution Request form online.

- Press the ‘Get Form’ button to access the IRA Distribution Request form and open it in your chosen editor.

- Provide your personal information in Section 1, including your name, street address, city, state, zip code, and account number in the designated boxes. Indicate any address changes if applicable.

- In Section 2, select the reason for your distribution by checking the appropriate box regarding your age and circumstances as per IRS regulations.

- In Section 3, choose the type of distribution you wish to make. Decide if you want a full account distribution, a one-time distribution, or systematic distributions. Include the required details for your selected option.

- In Section 4, indicate your withholding instructions, choosing whether you want federal taxes withheld from your distribution. If you select to withhold, specify the percentage.

- In Section 5, select your method of payment, choosing from options such as mailing a check to your address of record, to a different address, donating to a qualified charitable organization, or directly depositing into your bank account. Include any necessary banking details where applicable.

- Sign and date the form in Section 6, ensuring to include a Medallion Guarantee if required. Review the checklist provided in Section 7 to confirm you have completed all necessary steps and included required attachments.

- Once the form is completed, you can save any changes, download, print, or share the document as needed before mailing it to the specified address.

Start completing the IRA Distribution Request form online today.

Can I withdraw from a Traditional IRA? You may withdraw from a Traditional IRA at any time; however, withdrawals from your Traditional IRA are includible in your taxable income and if you are under age 59 ½ you may have to pay an additional 10% tax for early withdrawal unless you qualify for an exception.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.