Loading

Get Tax Return 2013

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Tax Return 2013 online

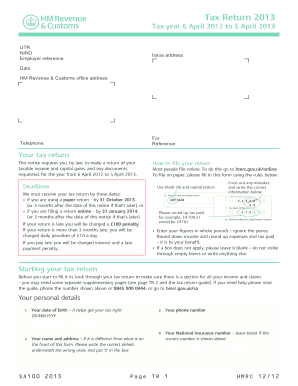

Filing your Tax Return for the year 2013 can seem daunting, but with the right guidance, it can be a straightforward process. This guide provides a step-by-step approach to help users complete their Tax Return online accurately and efficiently.

Follow the steps to fill out your Tax Return 2013 online.

- Click ‘Get Form’ button to obtain the Tax Return 2013 and open it in the editor.

- Enter your personal details in the designated sections. Fill in your name, address, date of birth, and National Insurance number where prompted.

- Detail your income sources for the tax year. This includes income from employment, dividends, and any state benefits. Pay close attention to input the amounts as specified in the instructions.

- Complete any relevant supplementary pages if you answered 'Yes' to queries regarding self-employment, capital gains, or overseas income. Follow the provided guidelines to fill in these sections accurately.

- Calculate any tax reliefs you may be eligible for and provide the necessary figures in the appropriate areas of the form.

- Review your entries for accuracy. Ensure that no fields are left blank unless instructed, and cross out any mistakes as needed.

- Once you have filled in all necessary sections, review the entire form again. Ensure all required boxes are checked or filled out and sign in the declaration section.

- Finally, save your changes and follow the prompts to download, print, or share your completed Tax Return 2013.

Complete your Tax Return online today to ensure timely submission and avoid penalties.

So, how can you access this information? HM Revenue & Customs (HMRC) provides the information online. or paper originals will continue to be acceptable if you do not have access to the internet. These can be ordered by you (or your Accountant) by calling 0300 200 3310.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.