Loading

Get Irs 14414 2012-2026

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 14414 online

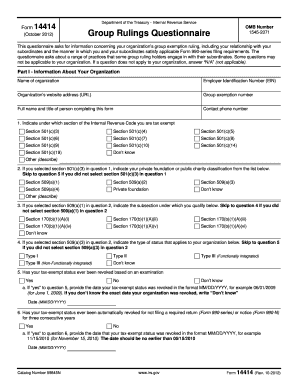

This guide provides detailed instructions on completing the IRS Form 14414, a crucial document for organizations seeking a group exemption ruling. By following these steps, you can accurately and efficiently fill out the form online.

Follow the steps to successfully complete the IRS 14414 online.

- Click ‘Get Form’ button to obtain the form and access it within your chosen editor.

- Begin by filling out Part I, which collects information about your organization. Include the organization's name, Employer Identification Number (EIN), website address, group exemption number, and full completion details.

- Indicate under which section of the Internal Revenue Code your organization is tax-exempt by selecting the appropriate options provided.

- Continue through the questions in Part I about your organization's tax-exempt status, and respond to questions that pertain specifically to your situation.

- Move on to Part II to provide details about your subordinates. Indicate how many subordinates are in your group and their respective tax-exempt status.

- Fill out the sections that pertain to the governance, activities, and services provided to your subordinates in Parts III through VI.

- Ensure you input all necessary information regarding any financial or operational interactions with your subordinates as required in the later parts of the form.

- Review all entries carefully to confirm accuracy.

- Once all sections are completed, you can save changes, download, print, or share your filled form as needed.

Complete your IRS Form 14414 online today to ensure your organization remains compliant.

Determining if you are subject to IRS withholding depends on your employment status and income level. If you receive payments subject to taxes, such as wages, the IRS usually requires tax withholding. Understanding IRS 14414 can assist you in clarifying your withholding obligations and ensuring compliance.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.