Loading

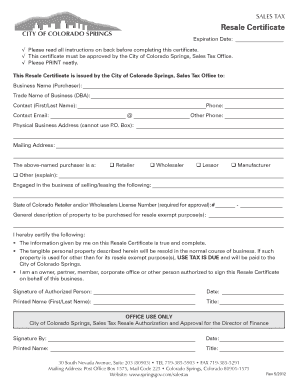

Get Colorado Resale Certificate

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Colorado resale certificate online

Completing the Colorado resale certificate is an essential step for businesses wishing to purchase goods without paying sales tax. This guide provides clear, step-by-step instructions to help you navigate the process online.

Follow the steps to complete your Colorado resale certificate with ease.

- Click ‘Get Form’ button to access the Colorado resale certificate form online and open it in the editor.

- In the 'Business Name (Purchaser)' field, enter the official name of your business clearly. Ensure it is spelled correctly as it will be crucial for validation.

- Next, fill in the 'Trade Name of Business (DBA)' if applicable. This is your business's commonly known name.

- Provide the contact person's first and last name in the respective fields, along with their phone number and email address. It’s important to ensure that the information provided is accurate for any necessary follow-ups.

- Complete the 'Physical Business Address' section with your business's actual address, noting that a P.O. Box cannot be used here.

- In the 'Mailing Address' field, fill in the address where you would like to receive correspondence, if different from the physical address.

- Indicate whether you are a retailer, wholesaler, lessor, manufacturer, or other by marking the appropriate box.

- Describe the type of goods you are engaged in selling or leasing in the next field.

- Enter your State of Colorado Retailer and/or Wholesalers License Number in the designated box, as this is required for approval.

- Provide a general description of the property you plan to purchase for exempt use in the following section.

- By signing the document, acknowledge that the information provided is true and that the property will be used for its intended purpose. Make sure the signature is from an authorized person.

- Finally, fill in the date and printed name of the authorized person, along with their title.

- Once completed, you can save your changes, download the form for your records, print it out, or share it with relevant parties to complete the submission process.

Complete your Colorado resale certificate online today and ensure your business complies with tax regulations.

A wholesaler license is required if you are selling your product to another business that will resell your product or use it as an ingredi- ent in another product to be resold. A whole- saler license cost $16 for a two-year period. Apply for the sales tax license on form CR 0100, “Business Registration.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.