Loading

Get 2012 Form It 209

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2012 Form IT-209 online

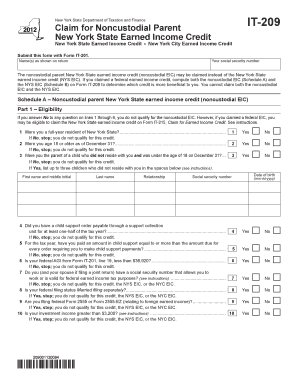

Filling out the 2012 Form IT-209 online can be a straightforward process when guided step-by-step. This form is essential for noncustodial parents looking to claim the New York State Earned Income Credit. This guide will walk you through each component of the form, ensuring you complete it accurately.

Follow the steps to fill out the form online effectively.

- Press the ‘Get Form’ button to access the form and open it in your editing tool.

- Enter your name(s) as shown on your return in the designated field at the top of the form.

- Provide your social security number in the space provided. Ensure it is accurately inputted for correct processing.

- In Schedule A, Part 1, answer all eligibility questions from lines 1 through 10. If you answer 'No' to any of these questions, you do not qualify for the noncustodial EIC.

- In Part 2, determine if you have already filed your NYS income tax return. If yes, you will need to file an amended return to claim your credits.

- Next, decide if you want the Tax Department to compute your noncustodial EIC for you. If yes, complete lines 13-17.

- Proceed to enter your earned income in the section outlined in Part 3. Be sure to follow the instructions provided for accurate calculations.

- Continue to Part 4, where you will compute your credit based on the information provided earlier. This will involve cross-referencing tables provided in the form's instructions.

- Finally, review all information filled in, then save your changes, download a copy for your records, and print or share the form as necessary.

Complete your Form IT-209 online today to ensure you receive the credits you qualify for.

If two parents both claim a child for the full amount on their tax returns, the IRS won't just let it slip by. They will eventually contact you and the other parent to determine who is entitled to claim the dependent.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.