Loading

Get Pt - 50 Pf Application For Freeport Exemption Inventory Due Date ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

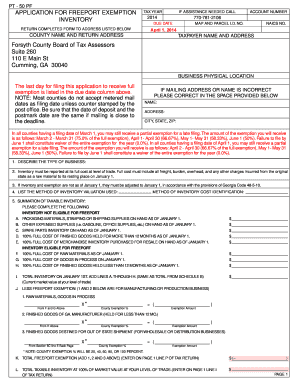

How to fill out the PT - 50 PF application for Freeport exemption inventory online

Filling out the PT - 50 PF application for Freeport exemption inventory can seem daunting. This guide provides clear, step-by-step instructions to help you complete the form online, ensuring you meet all necessary requirements and deadlines.

Follow the steps to successfully complete your application online.

- Click ‘Get Form’ button to access the application form and open it in the online editor.

- Enter the tax year in the designated field. Make sure to provide the correct year as it pertains to your application.

- Locate and fill in your account number. This number is essential for tracking your application.

- Insert your MAP and parcel I.D. number, which identifies the property associated with the inventory.

- Select the correct NAICS number that corresponds to your business type for accurate classification.

- Provide the county name and your return address where the completed form will be sent.

- Enter your taxpayer name and physical address. Verify that this information is accurate to prevent issues with your submission.

- Describe the type of business in the allocated text box, ensuring it reflects the correct nature of your operations.

- Report your inventory at its full cost as of January 1, including all relevant expenses such as freight and overhead.

- Select the method of inventory valuation used, and state your method of cost identification.

- Summarize your taxable inventory according to the sections provided, distinguishing between eligible and ineligible inventory for Freeport exemption.

- Calculate the total Freeport exemption and the total taxable inventory based on the details you filled out.

- Sign and date the oath section of the form, confirming the validity of the information provided.

- Review the entire application for accuracy and completeness before proceeding.

- Finally, save your changes, and you have the option to download, print, or share the completed form as needed.

Ensure your freeport exemption application is submitted on time by completing the form online today.

The Freeport Exemption is a personal property tax exemption for goods that are detained in the State for 175 days or less. Locally, the County offers the exemption to companies that deal with goods-in-transit or inventories used in the manufacturing process.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.