Loading

Get Pdf 2011 Form 8917 - Free Online Tax Return Free E-file ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the PDF 2011 Form 8917 - Free Online Tax Return Free E-File online

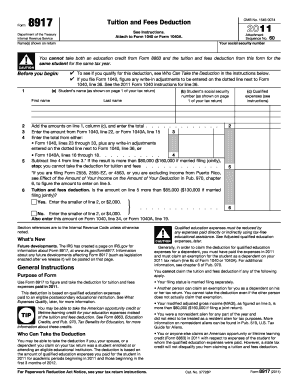

Filling out Form 8917 can be a straightforward process when done correctly. This guide provides a detailed, step-by-step approach to help you accurately complete the form online, ensuring that you take full advantage of the tuition and fees deduction available for the 2011 tax year.

Follow the steps to fill out Form 8917 correctly online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Complete the personal information section, including your name and social security number, as it appears on your tax return.

- Identify the student for whom you are claiming the deduction. Enter the student’s name and social security number in the appropriate fields.

- In column (c), enter the total amount of qualified education expenses paid for the student in 2011. Refer to the qualified education expenses definition to ensure accuracy.

- If applicable, make any necessary adjustments to the qualified education expenses as outlined in the instructions, such as reducing by tax-free educational assistance received.

- Calculate the total deduction amount based on the criteria provided. If your income is above the thresholds, note the limitations on the deduction.

- On the final line, enter the deduction amount as directed and ensure all calculations are correct. Validate this against the forms associated with your overall tax filing.

- Once you are satisfied with the entries, save your changes, download the completed form, and print it if necessary for submission with your Form 1040 or Form 1040A.

Start completing your forms online today to ensure you meet all tax requirements efficiently.

If you are age 65 or older, your standard deduction increases by $1,700 if you file as single or head of household. If you are legally blind, your standard deduction increases by $1,700 as well. If you are married filing jointly and you OR your spouse is 65 or older, your standard deduction increases by $1,350.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.