Loading

Get About Form 1099-patrinternal Revenue Service - Irs.gov

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the About Form 1099-PATR Internal Revenue Service - IRS.gov online

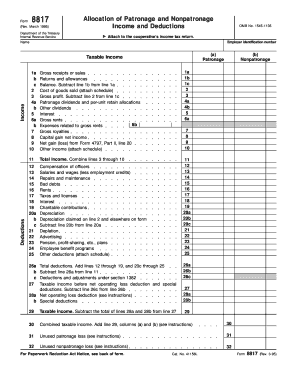

Filling out the About Form 1099-PATR is essential for cooperatives reporting their income and deductions. This guide provides a clear, step-by-step process to help users complete the form accurately online, ensuring compliance with IRS requirements.

Follow the steps to complete the About Form 1099-PATR online successfully.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin with entering the cooperative name and employer identification number at the top of the form.

- For line 1a, enter the gross receipts or sales from all business operations. Line 1b is for returns and allowances, which should be subtracted from line 1a to calculate line 1c.

- On line 2, input the cost of goods sold, ensuring to attach a schedule detailing your computations.

- For line 6a, report the gross amount received for rent and related income, detailing specific expenses for line 6b, which should include repair costs and other deductions.

- Complete line 10 with any other taxable income, providing explanations on an attached schedule if necessary.

- Proceed to the deductions section, starting at line 12, where you will list expenses like compensation of officers and wages.

- Ensure that the totals for both patronage and nonpatronage income and deductions are accurately detailed and totaled at the bottom of the form.

- After completing all sections, save any changes you made, and prepare for final actions like downloading or printing the filled-out form.

Start completing your forms online today to ensure accurate filings and compliance.

File Form 1099-PATR, Taxable Distributions Received From Cooperatives, for each person to whom the cooperative has paid at least $10 in patronage dividends and other distributions described in section 6044(b), or from whom you withheld any federal income tax under the backup withholding rules regardless of the amount ...

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.