Loading

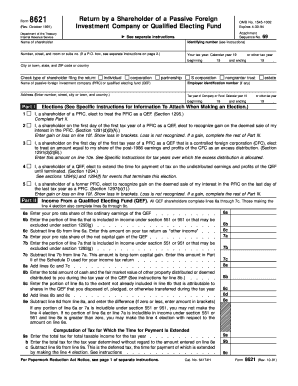

Get Form 8621 Return By A Shareholder Of A Passive Foreign ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 8621 Return By A Shareholder Of A Passive Foreign Investment Company online

Filling out Form 8621 is essential for shareholders of a Passive Foreign Investment Company or Qualified Electing Fund. This guide provides clear, step-by-step instructions to help users complete the form accurately and efficiently online.

Follow the steps to complete the form correctly.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your identifying information, including the name of the shareholder and their identifying number. Ensure that you provide an accurate number, street address, and suite or room number if applicable.

- Specify your tax year accurately by entering the beginning and ending dates, ensuring the formats align with your specified tax year.

- Select the type of shareholder filing the return by checking the appropriate box (individual, corporation, partnership, S corporation, or nongrantor trust).

- Fill in the name of the Passive Foreign Investment Company (PFIC) or Qualified Electing Fund (QEF), including the employer identification number, if available.

- Proceed to Part I to indicate any elections you wish to make related to your holdings in the PFIC or QEF by checking the relevant boxes for each election.

- If applicable, transition to Part II to report income from a QEF. Complete lines 6a through 7c, as necessary, detailing your pro-rata share of earnings and applicable attributes.

- In Part III, report distributions and dispositions, including total distributions received during the tax year, ensuring to follow the instructions carefully for each line.

- For distributions and dispositions—if applicable—make the necessary calculations according to the provided lines in this section, keeping an eye out for loss and gain entries.

- Once you have completed all relevant parts of the form, you can save your changes to the form and have options to download, print, or share it as needed.

Complete your Form 8621 online to ensure compliance and accurate reporting.

Related links form

A U.S. person that is a direct or indirect shareholder of a passive foreign investment company (PFIC) files Form 8621 if they: Receive certain direct or indirect distributions from a PFIC. Recognize a gain on a direct or indirect disposition of PFIC stock.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.