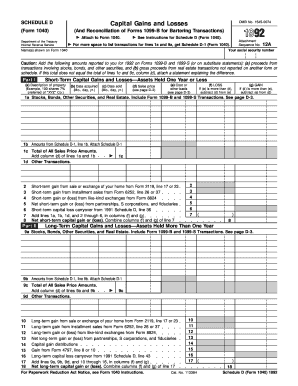

Get 1992 Form 1040 (schedule D). Capital Gains And Losses

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign 1992 Form 1040 (Schedule D). Capital Gains And Losses online

How to fill out and sign 1992 Form 1040 (Schedule D). Capital Gains And Losses online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

The preparation of lawful paperwork can be high-priced and time-consuming. However, with our pre-built online templates, things get simpler. Now, working with a 1992 Form 1040 (Schedule D). Capital Gains And Losses requires no more than 5 minutes. Our state browser-based samples and crystal-clear guidelines eliminate human-prone faults.

Comply with our simple actions to get your 1992 Form 1040 (Schedule D). Capital Gains And Losses ready quickly:

- Choose the web sample in the library.

- Complete all necessary information in the required fillable areas. The user-friendly drag&drop interface makes it easy to add or move areas.

- Check if everything is completed appropriately, without typos or lacking blocks.

- Use your e-signature to the page.

- Click Done to save the alterations.

- Download the data file or print your copy.

- Submit immediately to the receiver.

Make use of the quick search and innovative cloud editor to generate an accurate 1992 Form 1040 (Schedule D). Capital Gains And Losses. Get rid of the routine and produce papers on the internet!

How to edit 1992 Form 1040 (Schedule D). Capital Gains And Losses: customize forms online

Your easily editable and customizable 1992 Form 1040 (Schedule D). Capital Gains And Losses template is within reach. Make the most of our library with a built-in online editor.

Do you put off preparing 1992 Form 1040 (Schedule D). Capital Gains And Losses because you simply don't know where to start and how to proceed? We understand how you feel and have an excellent solution for you that has nothing nothing to do with fighting your procrastination!

Our online catalog of ready-to-edit templates allows you to search through and pick from thousands of fillable forms tailored for a variety of purposes and scenarios. But getting the document is just scratching the surface. We provide you with all the needed tools to fill out, sign, and modify the form of your choosing without leaving our website.

All you need to do is to open the form in the editor. Check the verbiage of 1992 Form 1040 (Schedule D). Capital Gains And Losses and verify whether it's what you’re searching for. Start off modifying the form by taking advantage of the annotation tools to give your document a more organized and neater look.

- Add checkmarks, circles, arrows and lines.

- Highlight, blackout, and correct the existing text.

- If the form is meant for other users too, you can add fillable fields and share them for other parties to fill out.

- Once you’re through modifying the template, you can download the file in any available format or select any sharing or delivery options.

Summing up, along with 1992 Form 1040 (Schedule D). Capital Gains And Losses, you'll get:

- A robust suite of editing} and annotation tools.

- A built-in legally-binding eSignature functionality.

- The ability to create documents from scratch or based on the pre-drafted template.

- Compatibility with different platforms and devices for greater convenience.

- Numerous possibilities for safeguarding your documents.

- An array of delivery options for more frictionless sharing and sending out documents.

- Compliance with eSignature frameworks regulating the use of eSignature in electronic operations.

With our full-featured option, your completed documents will almost always be officially binding and fully encrypted. We make certain to protect your most vulnerable details.

Get all it takes to generate a professional-hunting 1992 Form 1040 (Schedule D). Capital Gains And Losses. Make the best choice and attempt our foundation now!

Use Schedule D (Form 1040) to report the following: The sale or exchange of a capital asset not reported on another form or schedule. Gains from involuntary conversions (other than from casualty or theft) of capital assets not held for business or profit.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.