Loading

Get 2003 Form 8844

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2003 Form 8844 online

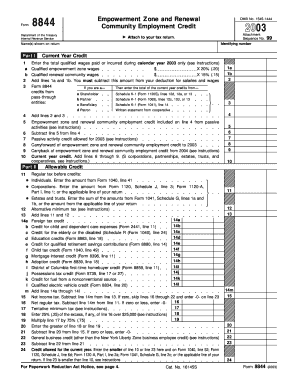

This guide provides users with a step-by-step process for accurately completing the 2003 Form 8844, which is used to claim the empowerment zone and renewal community employment credit. Follow these instructions to ensure your online filing is clear and compliant with the guidelines set forth by the Internal Revenue Service.

Follow the steps to complete the 2003 Form 8844 online.

- Click the ‘Get Form’ button to obtain the form and open it in your online editor.

- Complete Part I by entering the total qualified wages paid to empowerment zone and renewal community employees during the calendar year 2003. Input amounts on lines 1a and 1b, ensuring to multiply the respective wages by 20% and 15%.

- Add the figures from lines 1a and 1b. Enter the total on line 2 and remember to adjust your wage deductions appropriately.

- If relevant, report your current year credits on the appropriate lines where indicated. This is important for shareholders, partners, and beneficiaries, as outlined in the form.

- Proceed to Part II. Enter your regular tax amounts and any applicable credits from other forms as necessary, making sure to follow the instructions laid out for each line.

- Determine your allowable credit by subtracting any passive activity credits and complete the calculations for lines 22 and 24 where appropriate.

- Once all fields are complete, review the form for accuracy. You can then save changes, download, print, or share the completed form as needed.

Complete your Form 8844 online today for a smooth and efficient filing experience.

Use this form to claim the empowerment zone employment credit.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.