Loading

Get Govguamdocs

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Govguamdocs online

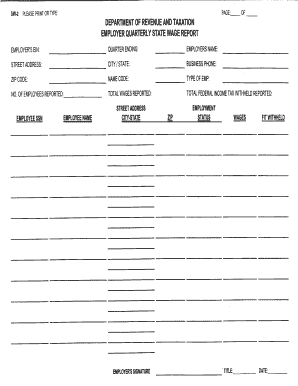

Filling out the Govguamdocs online can be a straightforward process if you follow the right steps. This guide is designed to assist you in completing the Employer Quarterly State Wage Report efficiently, ensuring that all necessary information is accurately provided.

Follow the steps to complete the Employer Quarterly State Wage Report.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In the Employer’s EIN field, enter your unique Employer Identification Number. This is essential for identifying your business for tax purposes.

- Indicate the quarter ending by filling in the appropriate date next to 'Quarter Ending.' This helps specify the period for which you are reporting wages.

- Provide the Employer’s Name in the designated space. This should be the legal name of your business.

- Complete the Street Address, City, and State fields with your business's physical address.

- Enter your Business Phone number to provide contact information.

- Fill in the ZIP Code for your business address.

- In the Name Code field, enter any specific code that refers to your business if applicable.

- Specify the Type of Employment in the corresponding field. This could include full-time, part-time, or other classifications.

- Indicate the number of employees reported for the quarter.

- Fill in the Total Wages Reported, which involves summarizing the wages paid to all employees during the quarter.

- List each Employee's SSN, Name, Street Address, City-State, and ZIP code in the designated sections. Ensure accuracy to avoid any issues.

- Sign the form in the Employer’s Signature section and date it. This confirms that the information is accurate and has been authorized by you.

- Enter the Total Federal Income Tax Withheld Reported. This is vital information for tax reporting purposes.

- After completing the form, save your changes. You may also opt to download, print, or share the form as needed.

Complete your Employer Quarterly State Wage Report online today.

Walk in to the Department of Revenue and Taxation, Collection branch. Make sure to bring a copy of your e-filed return with the watermark "E-Filed" shown across the page. Mail in your payment. Mail your check payable to "Treasurer of Guam" to the Department of Revenue and Taxation, P.O. Box 23607, GMF, Guam 96921.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.