Loading

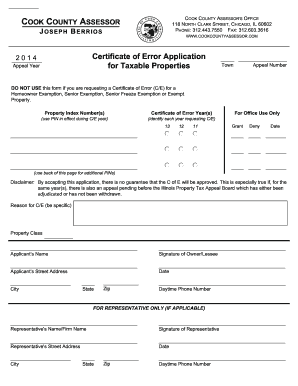

Get Certificate Of Error Application For Taxable Properties - Cook County ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Certificate of Error Application for Taxable Properties - Cook County online

Filling out the Certificate of Error Application for taxable properties in Cook County can be straightforward with the right guidance. This guide will help you navigate each section of the form and ensure that you provide all necessary information accurately.

Follow the steps to efficiently complete your application online.

- Press the ‘Get Form’ button to obtain the form and open it in your preferred browser.

- Start by filling in the 'Appeal Year' section, specifying the year for which you are requesting a certificate of error.

- Complete the 'Town' and 'Appeal Number' fields with the relevant information for your property.

- In the 'Property Index Number(s)' field, enter the Property Index Numbers (PINs) that are applicable to your property as they were during the error period.

- Next, specify the 'Certificate of Error Year(s)' by listing the years you are requesting corrections for, ensuring you use the PINs in effect during each respective year.

- Provide your 'Reason for C/E' by explaining the specific error you are addressing. It is important to be as detailed as possible to justify your request.

- Complete the 'Applicant's Name' and 'Signature of Owner/Lessee' sections with your name and signature.

- Fill out your contact information in the 'Applicant's Street Address', 'City', 'State', 'Zip', and 'Daytime Phone Number' fields.

- If you are representing someone else, complete the fields under 'FOR REPRESENTATIVE ONLY' with the representative's name, signature, and contact information.

- Before submitting, review all fields to ensure that they are accurately entered and complete. Once satisfied, you may choose to save, download, print, or share the completed form.

Complete your Certificate of Error Application online today to ensure timely processing.

Senior Citizens Real Estate Tax Deferral Program allows persons 65 years of age and older, who have a total household income of less than $55,000 and meet certain other qualifications, to defer all or part of the real estate taxes and special assessments on their principal residences.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.