Loading

Get Cd-401s Corporation Tax Return 2006 - N.c. Department Of ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CD-401S Corporation Tax Return 2006 - N.C. Department Of ... online

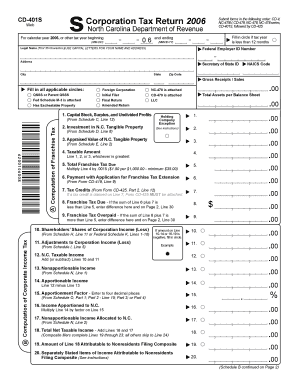

The CD-401S Corporation Tax Return is a crucial document for corporations operating in North Carolina. This guide provides clear, step-by-step instructions to help users efficiently complete the form online, ensuring compliance with state regulations.

Follow the steps to complete the CD-401S Corporation Tax Return online

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin filling in your legal name, as per the guidelines, using capital letters for the first 35 characters. Provide your Federal Employer ID Number and Secretary of State ID, followed by your address details—city, state, and zip code.

- Indicate the nature of your corporation by filling in applicable circles, including options like Foreign Corporation, Initial Filer, Final Return, or LLC.

- Complete the section on Capital Stock, Surplus, and Undivided Profits by entering the amounts from your book balance sheet as of the end of the tax year. This includes total capital stock outstanding and any retained earnings.

- Proceed to the Computation of Franchise Tax. You will need to calculate the taxable amount based on the greatest of capital stock, investment in N.C. tangible property, or appraised value of N.C. tangible property. Ensure that you multiply the taxable amount by the tax rate indicated.

- Input any tax credits you may qualify for as indicated on the form. Attach additional forms where required to support your claims.

- Fill out the Computation of Corporate Income Tax section, which involves determining your N.C. taxable income and any nonapportionable income.

- If applicable, complete the Shareholders’ Pro Rata Share Items section with details for each shareholder, including their income (loss) shares and percentage of ownership.

- Review all sections for accuracy and completeness. Once finalized, you can save changes, download a copy of the completed form, and/or print it for your records.

- Submit the completed form according to the instructions provided, ensuring any required payments or attachments are included.

Begin filling out the CD-401S Corporation Tax Return online today to ensure timely and accurate compliance with N.C. tax regulations.

Filing Requirements Chart for Tax Year 2022 Filing StatusA Return is Required if Federal Gross Income ExceedsSingle$12,750Married - Filing Joint Return$25,500Married - Filing Separate ReturnIf spouse does not claim itemized deductions$12,7504 more rows • Mar 24, 2023

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.